Real-World Barriers to Carbon Pricing

Economists’ ‘One-Page’ Climate Plans Won’t Work

-

-

Share

-

Share via Twitter -

Share via Facebook -

Share via Email

-

Ask an economist how to combat climate change, and you’re likely to get a pretty simple answer: put a price on carbon.

“If you let the economists write the [climate] legislation, it could be quite simple,” MIT business school economist Henry Jacoby told NPR last year, implying that the whole plan to curb greenhouse gas emissions could “fit on one page.”

In short, tax fossil fuels in proportion to the amount of carbon they release. Make coal, oil and natural gas more expensive. “That’s it; that's the whole plan,” as NPR’s David Kestenbaum put it.

Jacoby and MIT Sloan School colleague John Reilly envision a carbon tax sufficient to increase the price of gasoline by 25 cents in the first year, rising to $1.00 per gallon. In rough terms, that’s a tax of $25-100 per ton of CO2.

While many economists admit a slightly more nuanced view (acknowledging the need for “supplemental policies” to address other market failures hampering climate solutions, including innovation spillover risks and infrastructure lock-in) or prefer emissions trading programs instead of taxes, Jacoby and Reilly’s one-page climate plan isn’t far off from the typical economist’s prescription for climate change.

In economics-speak, climate change is “an externality” — a set of costs (e.g., climate change-related damages) that are external to current market transactions, since no one has to pay for the costs associated with their CO2 emissions.

As such, the traditional economic prescription for climate externalities involves establishing a “Pigouvian fee” on the sources of GHG emissions that corrects for the un-priced externality, either via a tax on carbon dioxide (CO2) and other GHGs (a “carbon tax”) or via a market-based emissions cap and permit trading mechanism (“cap-and-trade”). There’s a lot of debate about which approach — tax or cap-and-trade — is better, but both rest on a common economic foundation, and I’ll refer to both collectively as “carbon pricing policies.”

If these instruments successfully establish a carbon price equal to the full climate change-related external costs associated with emissions of CO2 and other GHGs (the so-called “social cost of carbon”), they will equalize the marginal social and private costs of GHG emitting activities, restoring an economically efficient of emissions (economists call this “a Pareto optimal level”).

There’s only one hitch: people generally want their energy to be cheaper, not more expensive!

In July, Australia repealed it’s carbon tax, ending a brutal, decade-long fight over climate policy. The repeal is just the latest and most glaring example of the extremely up-hill political battle facing any effort to put a hefty price on carbon—i.e., a price sufficient to fully internalize the social costs of CO2 emissions and substantially reduce greenhouse gas emissions.

In a new peer-reviewed paper published in the June edition of Energy Policy (Vol 69), I dive in to these “political economy constraints on carbon pricing policies” and their impacts on the economic efficiency and environmental efficacy of climate policy. From my paper:

“Several political economy factors can severely constrain the implementation of these carbon pricing policies, including opposition of industrial sectors with a concentration of assets that would lose considerable value under such policies; the collective action nature of climate mitigation efforts; principal agent failures; and a low willingness-to-pay for climate mitigation by citizens.”

What I find is that while estimates of the full social cost of carbon range from $15 to $150 per ton of CO2 in 2012 dollars (rising steadily each year), households in the United States may be willing to pay as little as $2 to $8 per ton to combat climate change, according to a range of public values and willingness-to-pay research.

In other words: that one-page climate plan sounds great in theory. In the real-world, political constraints can mean carbon pricing policies end up falling far short. That creates an opportunity for improved climate policy designs that perform much better under political economy constraints.

In a two-part series, I’ll first explain how and why political constraints frequently bind carbon pricing efforts and why that leads carbon pricing to fall short on its on terms. In a follow-up post soon, I’ll discuss the implications for climate policy design, and how to move towards more creative (and yes, complicated) policy proposals that might actually work in the real world…

Note, my Energy Policy paper is behind a paywall and can be accessed by anyone with aScienceDirect membership. For those who can’t access it and want a copy, please email me and I’m happy to send one along.

Part 1: Why is it so hard to tax carbon?

My paper surveys both the relevant political economy theory and presents evidence of political constraints in action drawn from public opinion and willingness-to-pay (WTP) research and the very public debate over climate policy in the United States in 2009 and 2010.

A brief disclaimer: This evidence is U.S.-specific and is not meant to be representative of other political economies. The political economy constraints posed by industrial interests and consumer WTP for climate policies will vary in each national or sub-national political economy. However, the evidence presented from the United States is highly consistent with the theoretical predictions and provides a real-world example of the potential for political economy constraints to be binding on the implementation of carbon pricing instruments. Furthermore, while political constraints differ from nation to nation, they certainly exist in all political economies. Policy makers and climate advocates ignore them at their peril…

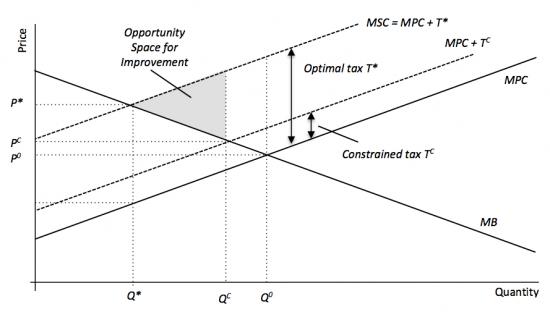

First off, we have to understand that while social welfare can be maximized under an efficiently implemented carbon tax or cap-and-trade system and government revenues may theoretically be recycled in a manner that maximizes overall welfare, the imposition of a carbon price causes consumers and producers alike to experience both a private welfare loss and a transfer of surplus to government tax revenues. You can see this in Figure S.1 and Table S.1 below, which are a little bit of Environmental Economics 101.

Source: Jenkins (2014). Click either image to enlarge.

The line “MPC” illustrates the hypothetical marginal private cost of activities that emit CO2 in the absence of a carbon price. Meanwhile, “MSC” is the marginal social cost, or the full cost incurred including the climate-related damages (the “externality”) associated with CO2 emissions. This marginal external cost, “MEC,” is the difference between MSC and MPC. MB is the marginal benefit of emitting activities, and constitutes the demand curve for emissions.

Here’s where that one-page carbon tax plan comes in: Price carbon at a tax T* equal to the marginal external cost and the quantity of carbon emitted should fall from Q to Q*. The result: overall social welfare improves by the area of the triangle hkl, which is the portion of the externality that’s erased by the carbon tax. That’s the “magic” of the carbon price as it’s supposed to work in theory.

But these figures also demonstrate the substantial private welfare losses incurred by both producers and consumers, who see their own welfare shrink: from the big triangle adl to the little triangle abh for consumers and from dfl to efj for producers. Overall societal welfare may go up, but individual producers and consumers will see their own private welfare fall. That’s the very nature of an externality! What was once a free ride is now “internalized” and we all have to pay up. Ouch!

By design, pricing carbon will increase factor prices for carbon-intensive energy products and other intermediate and end-use products that involve GHG emissions during production or distribution. This increase in factor prices will cause a redistribution of economic resources as production and consumption shift (over time) to a new, less carbon-intensive equilibrium. However, while Figure S.1 above presents the transition from one market equilibrium to another (i.e. from Q to Q*) as costless, or “frictionless,” such transitions in reality can impose substantial additional private costs, as some assets — from power plants and factories (physical capital) to worker skills (human capital) — are simply worth much less under this new equilibrium and represent real “sunk costs.”

It doesn’t take a political scientist to see how there might be some political friction associated with the private costs imposed by carbon pricing. But just to be sure, political scientists have developed a series of theoretical frameworks that explain what’s going on here, which I survey in my paper. I’ll summarize those (intuitive) theories briefly here.

First off, several industrial sectors possess a high concentration of assets that would lose considerable value under carbon pricing policies. Think owners of those Australian coal mines, utilities with dirty power plants, or carbon or energy-intensive industries like steel or cement manufacturing. Political scientist Dale Murphy calls these firms with “high asset specificity,” and these sectors are likely to mount vociferous opposition to such policies to protect the value of their sunk investments.

Highly motivated industries also frequently exert their influence over political processes, and Nobel Laureate George Stigler is famous for developing an “economic theory of regulation” that documents how such interests frequently “capture” regulatory processes for their own ends. Theory predicts the same behavior to be rampant when carbon pricing policies are proposed, which can effectively prevent carbon pricing in the first place or distort policy design to favor impacted industries (think carve-outs and exemptions for “trade exposed” industries, free carbon credits, and plentiful low-cost “offsets” in many real-world climate policies).

At the same time, additional political economy constraints primarily arise from a geographic and temporal mismatch between the broad societal benefits of mitigation and the private costs borne by consumers and citizens.

The private costs of climate mitigation will be felt in the near-term and, assuming an equitable distribution of mitigation responsibilities, will be felt most severely in advanced industrialized nations such as the United States.

In contrast, the vast majority of benefits from climate mitigation will be enjoyed by future generations and will be diffused across the entire planet. In fact, assuming poor nations are most vulnerable to weather extremes and changing climate patterns, benefits may be concentrated to a greater degree in developing economies.

Efforts to mitigate climate change must therefore confront two tricky challenges:

- First, the main actors required to mitigate emissions face a higher share of the mitigation costs than the benefits (dubbed by political scientists and economists a “principal-agent” problem): current generations (and mostly in rich nations) pay the most, but future generations (and mostly in poor nations) benefit the most.

- Second, the huge number of actors required to take simultaneous action to reduce emissions introduces the mother of all collective action challenges, introducing strong incentives to “free ride” and let others pick up the cost of mitigation. No nation, let alone any individual, can solve climate change alone. As a result, unless you have confidence everyone else is going to pitch in and work together, it’s hard to justify taking on any significant mitigation costs yourself.

These theories would predict that individuals and nations should be willing to pay much less for climate mitigation than is ideal. Given the principal agent and collective action challenges, it’s actually perfectly rational to be willing to pay much less than the full social cost of carbon, as worries about free ridership, lack of confidence in collective action, and the mismatch between the near term costs and the long-term and diffuse benefits shift everyone’s economic calculus.

The result: when governments try to price carbon, we don’t end up with anything close to the ideal carbon pricing plan economists envision. Instead, these various political economy constraints become binding, restricting the level of carbon price possible and often halting carbon pricing efforts long before you get the ideal social price.

In my paper, I survey available evidence from both academic willingness-to-pay (WTP) surveys and public opinion research during the contentious U.S. debate over climate change legislation (the “Waxman-Markey bill”) during 2009 and 2010. What I found is that all available evidence indicates households in the United States are willing to pay just $80 to $200 per household per year to help combat climate change.

In other words, while Americans broadly view climate change as a problem and want to see something done about it, they’re just not willing to pay all that much to confront the problem—just as theory would predict. One study by Yale’s Matthew Kotchen and Anthony Leiserowitz and Virginia Tech’s Kevin Boyle illustrates just how quickly support for climate policy falls when the price tag starts to rise.

Figure 2. Willingness-to-pay for climate mitigation under different policy instruments (Kotchen et al. 2013)

Source: Jenkins (2014). Click image to enlarge.

Taking into account variance in household size, consumption patterns, and carbon intensity of electricity supply, average household CO2 emissions range from approximately 25 to 48 metric tons across the 50 states and the District of Columbia. The average U.S. household emits about 34 metric tons.

Combing this estimated willingness-to-pay range with the distribution of average household emissions presented above implies that, within the United States context, political opposition from citizens is likely to mount quickly for carbon pricing policies as the imposed price moves upwards in the range of roughly $2–$8 per ton. That’s a pretty small carbon tax! (Note: Other national or sub-national political economies may exhibit varying tolerance levels for carbon pricing, reflecting both differences in WTP and average household emissions.)

In marked contrast, economic estimates of the social cost of carbon range from roughly $15 to $150 per ton in 2012 dollars, with economists envisioning prices rising steadily each year. See Figure 3 below, for a representative range of social cost of carbon estimates. (The variance in these estimates derives predominately from differing choices of social discount rates [DR] applied to account for the inter-temporal distribution of mitigation costs and benefits, although other factors are also important).

Figure 3. Selected estimates of the social cost of carbon

Source: Jenkins (2014). Click image to enlarge.

In short: real-world political economy constraints in the United States may bind carbon pricing policies long before they reach the ideal pricing levels envisioned by economists. Indeed, a politically feasible carbon price in the United States may be anywhere from 60 percent to roughly two orders of magnitude lower than estimates of the full social cost of carbon.

So what happens to that one-page climate plan that started off this story? Well unfortunately, these political economy constraints mean things don’t work out quite as planned, and a politically-constrained carbon tax can’t deliver either the economic efficiency or environmental efficacy envisioned by economists.

Figure 4. Politically constrained carbon price and the opportunity space for improvement.

Source: Jenkins (2014). Click image to enlarge.

As illustrated in Fig. 4 from my paper above, the economic theory behind carbon pricing policies envisions the implementation of an “optimal” carbon tax T* such that T* equals the full social cost of carbon (as in Fig. S.1 above).

In the real-world, however, political constraints mean efforts to price carbon probably result in a tax TCwell below T*. This constrained carbon price can only increase the price of the carbon-emitting good, Gto PC and reduce consumption to QC. This constrained carbon price thus fails achieve the Pareto optimal equilibrium, leading to remaining external damages in excess of marginal social benefits (the shaded area in Fig. 4) and to continued excess CO2 emissions (equal to Q*–QC).

In other words: on its own terms, a politically-constrained carbon price is neither economically efficient nor environmentally efficacious. So much for that one-page climate plan…

In Part 2 of this series, I talk about the opportunity space this creates for creative climate policy designs that can out-perform the traditional carbon pricing prescription.

Don’t worry! That one-page climate plan probably can’t get the job done in a world of real and often-binding political constraints. But that doesn’t mean climate policy is sunk. It’s just time to get more creative…

Jesse Jenkins is a PhD student and researcher at the Massachusetts Institute of Technology. At MIT, Jesse works as a researcher with the "Utility of the Future" project and is an MIT Energy Initiative Energy Fellow and a National Science Foundation Graduate Research Fellow. He earned an M.S. in Technology & Policy from MIT in June 2014.