Two Pillars, Not Three

On Mitigation vs. Innovation in Hydrogen Production

-

-

Share

-

Share via Twitter -

Share via Facebook -

Share via Email

-

It looks like hydrogen’s “three pillars” are wobbling.

For those who haven’t been following the controversy: The Inflation Reduction Act (IRA) contains the Section 45V tax credit for clean hydrogen, which provides hydrogen suppliers up to $3 per kilogram of hydrogen they produce. But when hydrogen is produced through electrolysis, and if the electricity used in that reaction comes from coal or gas plants, then that might result in higher system-wide emissions even if the hydrogen ultimately displaces fossil fuels for the end consumer.

To avoid this, a group of energy systems experts proposed a set of strict criteria that hydrogen producers would need to satisfy to become eligible for the tax credit. To do so, the power plants fueling electrolysis must be located in the same region as the hydrogen plant, built within the previous three years, and generate low-carbon electricity within the same hour of hydrogen production. These criteria—deliverability, additionality, and hourly matching—became known as the “three pillars.”

As Princeton’s Jesse Jenkins, one of the experts who developed the framework, said, “We need to be mindful that [the hydrogen tax credit is] implemented in a way that actually accomplishes its goal of promoting low-carbon hydrogen production.” Leah Stokes, a professor at UC Santa Barbara, made the case for the three pillars in the New York Times last spring, arguing that “lax standards will reward bad behavior and undermine the potential of clean hydrogen.” And until recently, it seemed likely that the Treasury Department would formalize the three pillars framework into the US Tax Code.

But as Emily Pontecorvo reported last month in Heatmap, it now appears that the three pillars are “crumbling.” Part of this crumbling can be explained by pressure from much of the hydrogen industry, lawmakers, and even other federal agencies for Treasury to adopt looser guidance. Part of it comes from the recent downfall of the Chevron doctrine, which likely makes it harder for agencies to craft meaningful restrictions unspecified by Congress.

But beyond industry self-interest and judicial uncertainty, there are other good reasons for policymakers to adopt a less-strict approach to hydrogen regulation. Nurturing a strategically important new technology or industry is a fundamentally different policy task than regulating emissions. Loosening the regulations on hydrogen prioritizes long-term energy abundance and innovative dynamism over short-term mitigation and technocratic control.

Innovation vs. Mitigation

Granted, the specifics of hydrogen innovation are highly complex. Building a solar farm in the desert will reliably reduce coal or natural gas usage in power plants connected to the same grid; likewise, as has been covered extensively over the past decade, a marginal mile driven in an electric vehicle will produce less emissions than a mile driven with an internal combustion engine, even if the electricity is overwhelmingly generated by fossil fuels. Hydrogen, though, is neither an energy-generating nor energy-consuming technology, but an energy carrier. Its production really can create more emissions than its consumption displaces. And even if hydrogen production verifiably relies on clean electricity, those electrons might otherwise have gone towards displacing coal or gas serving load elsewhere on the grid.

Those complexities explain why the 45V tax credit is for clean hydrogen—specifically, according to the text of the IRA, “hydrogen which is produced through a process that results in a lifecycle greenhouse gas emissions rate of not greater than 4 kilograms of CO2e per kilogram of hydrogen.” The size of the credit received furthermore scales by tier, based on how much producers are able to shrink their hydrogen carbon footprint below that threshold. The three pillars advocates are simply attempting to satisfy the requirements of the law.

That said, the pillars go further than statutory requirements for other low-carbon fuels and technologies. For instance, federal 45Q tax credits for carbon captured by direct air capture facilities do not consider the carbon footprint of the electricity powering such projects. Nor do IRA’s 45X tax credits rewarding domestic production of solar polysilicon or solar wafers mandate that these highly energy-intensive solar manufacturing inputs source low-carbon electricity to reduce U.S. grid emissions.

Stricter requirements for solar manufacturing or direct air CO2 capture tax credit eligibility would trade off against scaling those industries, perhaps ensuring that the emissions footprint of subsidized solar farms and direct air capture were minimized but at the cost of reducing overall deployment of both. And, notably, there is significant expert disagreement over the actual emissions effects of the clean hydrogen subsidy.

Carnegie Mellon professor Paulina Jaramillo and her colleagues performed their own literature review and modeling of hydrogen production under the 45V tax credit and found that the life-cycle, cross-sectoral emissions effects of new hydrogen production would be mostly negligible regardless of the stringency of the eligibility requirements. But, they warn, stronger regulations could create uncertainty and administrative burden that “could exacerbate the ‘chicken and egg’ dilemma, where potential hydrogen consumers hesitate to invest due to uncertain supply, and suppliers refrain from investing due to insufficient demand.” As Jaramillo put it to Heatmap’s Pontecorvo, “We need to deploy it now so it’s available later.”

These sentiments were cited and shared by thirteen US Senators in a letter to Secretary Janet Yellen opposing the strict three-pillars framework. As the Senators wrote, “Treasury’s guidance would jeopardize billions of dollars of investment in clean hydrogen projects, render the cleanest forms of hydrogen uneconomical, and imperil efforts to decarbonize hard-to-abate sectors of our economy.”

To complicate matters further, other analyses differ with Jaramillo’s conclusions on emissions implications, while further disagreeing amongst themselves on how the strictness of eligibility criteria will affect the U.S. clean hydrogen sector.

Two studies by EPRI and Evolved Energy Research find that varying 45V criteria produces very different emissions impacts, potentially producting 50-100 megatons of annual emissions in 2030 when contrasting ‘three pillars’ with ‘no pillars’ scenarios (relative to 6343 Mt CO2 emitted nationwide in 2022). Yet EPRI’s modeling suggests that different eligibility criteria swing future annual hydrogen production on the order of a couple million tons (range of ~3 to ~7 Mt electrolytic hydrogen per year in 2030), while Evolved Energy’s study projects a more rosy future for hydrogen production regardless of the stringency of the regulations (range of 8.3 to 10.6 Mt H2/yr in 2030). Paradoxically, Jaramillo et al.’s modeling agrees more closely with Evolved Energy’s conclusion that the choice of criteria largely doesn’t affect near-term H2 production, but anticipates only limited production of ~1.6 Mt H2/yr by 2030.

In essence, what these and other competing studies really highlight is that nobody is really sure how bullish or bearish to be on the near-term techno-economics and market potential of clean hydrogen electrolysis to begin with. So we have no precise idea of how more stringent or less stringent criteria will affect electrolyzer project deployment or resulting grid emissions. As such, this suggests we should keep focusing on hydrogen tax credit criteria as an innovation policy vehicle first, while making reasonable efforts to implement some emissions safeguards.

Two Pillars, Not Three

There are a number of workable policy arrangements on the table now that could boost deployment and lower administrative and legal burdens while upholding the legal emissions mandate written into the IRA. The simplest compromise might rely on two pillars, not three.

Two is, of course, greater than zero. Without any regulatory requirements at all, it would be easy to, for instance, acquire a cheap electrolyzer, install it at a coal plant, purchase dubious bargain-bin renewable energy offsets, and reap $3 per kilogram of subsidies for producing hydrogen that’s actually higher-emissions than conventional methane reforming. Among other things, this would be a plausible path towards extending the lifespan of the country’s remaining coal fleet.

So some sort of deliverability and matching requirements probably make sense, to ensure that the hydrogen production capacity is physically connected to low-carbon generation sources, and that generation of low-carbon electricity is synchronous with hydrogen production. Different studies come to different conclusions about the effect of the matching requirement, although in principle hourly matching would strongly incentivize industry to develop and adopt more innovative electrolyzer technologies that can either ramp production up and down rapidly in conjunction with variable renewable power, or pair affordably with firm, clean generation.

But the additionality pillar risks a large near-term deployment tradeoff by insisting that hydrogen production use electricity only from newly-built rather than existing clean power generation facility. The concern additionality seeks to address is that existing low-carbon power plants will redirect a portion of their generation towards electrolytic load, and the residual load left on the grid will be filled in by coal or natural gas.

First, this level of fine-tuning is not how the shared public resource of the electric power grid is supposed to work. It’s true that electricity used to produce electrolytic hydrogen could otherwise go towards electric vehicle charging or wastewater treatment or whatever, and that all else equal these sources of load might otherwise be supplied by fossil fuels. But that’s a reason to build a system of low-carbon electric power abundance, not to dictate through the Tax Code what sources of load are worthwhile or not. If we don’t think hydrogen production, even verifiably green hydrogen production, is worthwhile, we shouldn’t be subsidizing it in the first place.

Second, allowing some hydrogen projects to source eligible clean electricity from a limited margin of existing clean power facilities arguably provides a greater benefit from near-term deployment and learning than any associated costs from induced emissions. Many estimates of the emissions impacts from looser additionality criteria are clearly aggressive, with Rhodium Group’s analysis for example assuming that electrolyzers are deployed to the hilt at every existing relicensed nuclear and hydropower facility in the country, local economic and common sense considerations notwithstanding. In practice, ample room exists to right-size additionality criteria in ways that encourage more near-term deployment for minimal emissions impacts.

Such considerations emphasize why we should not think of technology policy as a different kind of emissions policy. The two are distinct. The reason to subsidize solar panels, electric vehicles, or green electrolysis is not simply because the political economy of a carbon price is unattractive. Low-carbon energy subsidies are not a substitute for carbon emissions penalties, but rather a method through which the government can incentivize and cultivate new industries to ultimately reduce or even obviate the cost of transitioning away from fossil fuels. In the Paretian sense, carbon prices optimize for static efficiency—achieving the lowest-cost emissions reduction in the present—while subsidies optimize for dynamic efficiency—building functional low-carbon energy systems in the future.

Death, Taxes, and Technocratic Hubris

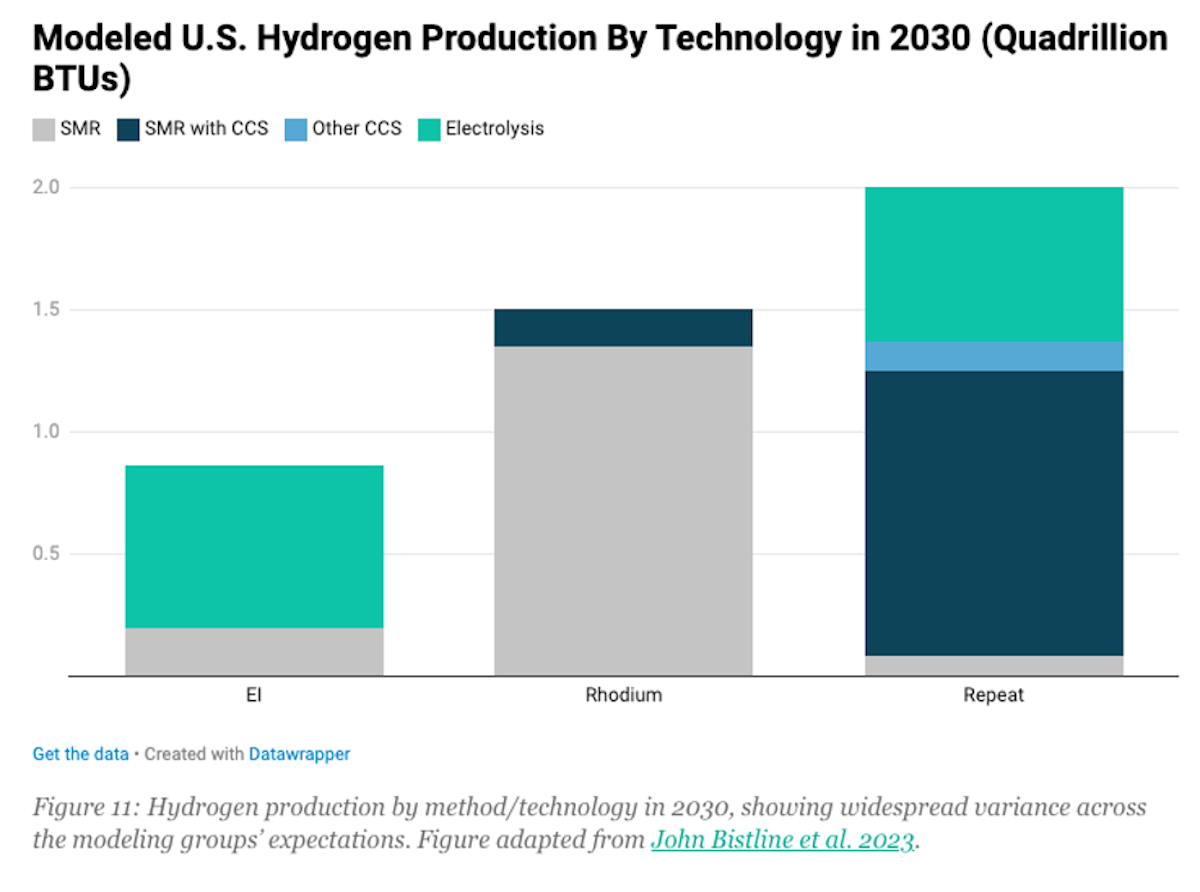

Of course, no one has any idea what that future will look like. As Jaramillo and her co-authors put it, “energy models do not encompass all real-world dynamics that can affect outcomes.” And as alluded to above, the size and scope of the US hydrogen economy just six years from now could differ by at least 100% depending on which prominent energy modeling shop you trust:

The shape of the energy system ten, thirty, and fifty years down the line is simply impossible to predict with any high degree of confidence or resolution. In one possible future, demand for clean hydrogen stagnates along with the expansion of the electric power grid, leading to fewer emissions tradeoffs in electrolytic hydrogen production but also slower decarbonization of both electricity and other end-use applications. Or, we can imagine a future in which demand for clean hydrogen skyrockets, as ammonia producers, long-distance shipping, and other large industrial and commercial applications switch over to the fuel, while renewables, nuclear, geothermal, and carbon removal technologies combine to create a new era of electric power abundance in the United States. In that scenario, there is plenty of electricity to go around, and the emissions effects of hydrogen production and fuel displacement become negligible. Or, perhaps most likely, the future will unfold somewhere between or outside this spectrum of possibilities.

As much as possible, we should expect our energy policies to be robust to a range of possible technological futures, instead of expecting them to build precisely the technological future any of us might prefer. In other words, we should choose techno-optimism over technocratic optimism.

Treasury will soon have to identify some set of statutory emissions guardrails for 45V. It seems likely at this point that those guardrails will be looser than the strict three-pillars approach. Adding greater flexibility the additionality requirement is one straightforward way to balance the deployment versus emissions impacts of different clean hydrogen eligibility requirements, though there are other conceivable arrangements. But regardless of the final rules, the ultimate success of the hydrogen industry will be determined by significant cost reductions in electrolyzers, enabling storage and pipeline infrastructure, highly abundant electricity generation capacity, and, most importantly, substantial growth in end-use demand for the fuel.