A Tale of Two Technologies

What Nuclear's Past Might Tell Us About Solar's Future

-

-

Share

-

Share via Twitter -

Share via Facebook -

Share via Email

-

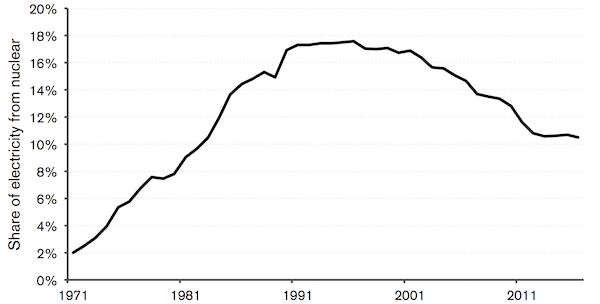

In 2011, the nuclear industry had a meltdown. In a literal sense, three reactors at Japan’s Fukushima Daiichi nuclear plant melted down after an earthquake and resulting tsunami, forcing mass evacuations of nearby residents. But the symbolic fallout wasn’t limited to Japan. Since 2011, the global nuclear industry has begun to melt down, as countries from Germany to the United States have shut down reactors at an accelerating pace and industry titans have hemorrhaged profits. As more reactors in the aging global fleet reach retirement without new ones to replace them, the world’s production of nuclear electricity might never return to its peak share of global electricity achieved in the 1990s (Figure 1).

By contrast, 2011 was a banner year for solar power. That year, the total installed capacity of solar power around the world nearly doubled, driven by a surge in Chinese-manufactured solar panels that plunged costs by a third. The solar industry hasn’t looked back since, growing at an annual rate of 18 percent and accounting for nearly 2 percent of the world’s electricity by 2016. Even though nuclear still supplies more than five times that figure, countries around the world are betting on ascendant solar to deliver abundant clean energy, power economic growth, and make up for the decline in nuclear energy. As the cheapest and fastest-growing power source on the planet, solar looks unstoppable today.

Figure 1: Global deployment of nuclear and solar power over the last half-century

Panel A plots the proportion of global electricity that was generated by nuclear energy in every year from 1970 to 2016. Panel B plots the proportion generated by solar energy. Source: World Bank, International Energy Agency, BP, International Renewable Energy Agency.

But this isn’t the first time that countries have pinned their hopes on a revolutionary clean energy technology to solve a range of their problems. Way back in 1954, Lewis Strauss, chairman of the US Atomic Energy Commission, predicted that within a generation, nuclear power would be “too cheap to meter.” One of his successors, Glenn Seaborg, went further, predicting in 1969 that abundant nuclear power would alleviate water and food scarcity, power automated factories, and enable everyone to work a twenty-hour week.

It turns out, in fact, that the histories of solar and nuclear are closely intertwined. In the postwar period, nuclear monopolized global attention — and funding — leaving only the most fringe applications and markets to the nascent solar industry. Now that the tables have turned and countries are shifting their investment decisions away from nuclear and toward renewables such as wind and solar, it is tempting for the solar industry to want to finally leave nuclear behind in the rearview mirror.

That would be a mistake. The two energy sources are complementary — intermittent solar power that only works when the sun shines will likely come to depend on the reliability of nuclear energy to balance out its fluctuations in a decarbonized electricity system. Both are necessary for a global clean energy transition. And only by learning the lessons from nuclear’s meltdown can solar avoid its own.

This isn’t an obvious comparison. Accidents, activists, and ascending costs have plagued nuclear, stymieing plans for new reactors across the developed world. From this perspective, the history of nuclear power has very little to do with how the future of solar power might unfold. It’s hard to imagine a solar farm melting down and inciting an equivalent political backlash as was seen after Fukushima, for instance, while the costs of solar have steadily fallen and will likely continue to decline.

The world would be wise to keep the nuclear industry’s experience in mind as it tries to bridge the gap between solar’s promise tomorrow and its limits today.

But there is a deeper reason that nuclear power may provide a cautionary tale for solar power. After a period of scientific ferment in the postwar era, nuclear technology has stagnated. For over a half-century, nearly every nuclear plant built around the world has been a light-water reactor, a design that in rare instances, like Chernobyl or Fukushima, can allow a meltdown. Advanced designs that could be cheaper, more efficient, and meltdown-proof have remained on the drawing board for decades.

Solar power could very well experience a similar technological stagnation. Nearly every single solar photovolataic (PV) panel sold around the world is made of silicon. Over the last half-century, researchers and companies have brought silicon solar panels near their theoretical performance limits, in some cases converting over 20 percent of the sun’s energy to electricity. Yes, every year solar panels get cheaper, but the gains are wrung from incremental optimization of manufacturing lines and supply chains, not breakthroughs in the lab. At the same time, there is worryingly little investment in innovation from massive firms in Asia that dominate the industry. In the short term, solar’s rise will continue unimpeded. But in the long run, as electricity grids attempt to integrate large amounts of intermittent solar power, the cost of today’s technology is unlikely to fall fast enough to justify solar’s eroding value.

So the world would be wise to keep the nuclear industry’s experience in mind as it tries to bridge the gap between solar’s promise tomorrow and its limits today. Nuclear’s travails represent a major setback in the global quest to curb carbon emissions; if solar’s rise similarly stalls, then the world won’t get a third try at decarbonization before the potentially catastrophic impacts of climate change set in.

1.

The nuclear and solar energy technologies used today were invented within a decade of each other in the middle of the 20th century. But the advent of silicon solar technology was overshadowed by nuclear power’s celebrity, borne of the success of the Manhattan Project, its glittering lineup of eminent scientists, and the fascination of political leaders with harnessing the power of the atom. That would leave the nascent solar industry to scour remote settings on and off the planet to peddle its wares.

In 1953, Gerald Pearson and Calvin Fuller — researchers at Bell Laboratories who had helped invent the silicon transistor, the building block of the modern computer — realized that their device was highly sensitive to light. They recruited Daryl Chapin, who was looking for a way to power remote telephone installations, and the trio built the first silicon solar PV cell. By 1954, Bell Labs had unveiled a 6 percent efficient PV cell to great fanfare; the New York Times reported that the advance could lead to “the harnessing of the almost limitless energy of the sun for the uses of civilization.”[1]

Unfortunately, the timing couldn’t have been worse. In 1953, President Dwight D. Eisenhower delivered his “Atoms for Peace” speech to the United Nations General Assembly, laying out his vision for “universal, efficient, and economic usage” of nuclear power.[2] This vision would captivate popular imagination about — and monopolize government support for — nuclear technology, eclipsing any buzz surrounding solar power. The stark contrast between the two was marked by the pageantry of the 1955 Atomic Conference in Geneva, which attracted heads of state. In comparison, the inaugural World Symposium on Applied Solar Energy, held three months later in Phoenix, Arizona, barely attracted media coverage.

This isn’t the first time that countries have pinned their hopes on a revolutionary clean energy technology to solve a range of their problems.

At the time, solar technology was still prohibitively expensive — a 1-watt cell cost $286 to produce, implying a cost of $1.4 million to power a single American home. With all eyes on nuclear, the research and development funding necessary to drive this cost down was not forthcoming. During the 1950s, US government funding for solar R&D was limited to less than $1 million per year, whereas R&D for civilian and military nuclear power topped $2 billion a year (both figures are in 2017 dollars).[3] As a result, the use of solar PV technology for commercial power generation languished while nuclear power boomed.

But even as President Eisenhower pulled the rug out from under the fledgling solar industry with Atoms for Peace, just two years later, in 1955, he gave it new hope by announcing America’s intention to launch a satellite, kicking off the space race. Solar quickly emerged as the only solution to powering satellites indefinitely — onboard batteries or fuel would run out after several days of use. The Soviets were first into space with their Sputnik satellites, but when the United States launched its Vanguard I satellite in 1958, its solar-powered radio lasted far longer.

Over the next decade, as the space program ballooned, it provided a steady stream of orders for solar panels, sustaining a $5–15 million market.[4] These crumbs enabled a few firms to invest in developing increasingly efficient solar panels, as it was crucial to extract as much energy as possible from the limited number of panels that could be sent into space. Thanks to the space race, the fledgling solar industry slowly grew in size and sophistication.

The early applications of solar power on Earth itself cropped up far from civilization. An advantage of solar over petroleum fuels or batteries was its low maintenance — you could leave a solar panel out for a decade or more and it could be trusted to generate power every day. That made it attractive for settings where routine maintenance was impractical. Australia used solar panels to power telecommunications repeaters and distant phone systems across the Outback; Exxon financed its own company, the Solar Power Corporation, to deploy solar systems on its offshore oil rigs in the Gulf of Mexico in the 1970s.[5],[6]

While the solar industry slowly developed on the margins of society, the nuclear industry boomed. Throughout the 1980s, a new nuclear reactor started up every 16 days, on average. Over 200 were built that decade, fueled by construction spurts in the United States, France, and Japan.

Today, that situation has reversed. Having emerged from nuclear’s shadow, solar is in the middle of a boom of its own, thanks to the manufacturing prowess of Asian firms, principally Chinese, that have driven down the cost of silicon solar panels.

2.

Today, solar is growing faster than any other source of energy on Earth, and the industry appears poised to continue growing rapidly for several years. Thanks to ongoing cost declines, market analysts are bullish about solar’s deployment prospects on every continent save Antarctica. Bloomberg New Energy Finance projects that by 2040, the cost of solar PV will plummet by two-thirds, and as a result, solar will account for 17 percent of total electricity generation. This would be especially impressive given that electricity demand is projected to grow rapidly in emerging economies, driven by urbanization, economic growth, and the rise of new sources of demand, such as electric vehicles. If Bloomberg has it right, solar will grow by more than 1,500 percent through 2040. More than 40 percent of that growth is forecasted to occur in China and India, both poised for explosions in solar PV deployment.

Yet that explosive growth might hit a ceiling if solar’s rise causes its own undoing. As the cost of generating solar power steadily falls, the value of consuming that electricity could fall even faster. The reason for this decline in value lies with solar’s intermittency; high levels of solar deployment would supply power in excess of customer demand in the middle of the day, and this strain on power grids would require costly solutions. This so-called “value deflation” could plunge solar’s value below the gently falling cost of producing it, thereby undermining the economic benefits of adding more solar power to the grid. In that case, solar’s current economic appeal would turn out to be an illusion — a poor predictor of solar’s future prospects.

It turns out that solar can lose more than two-thirds of its value when it provides one-third of a region’s electricity.

Because solar generates most of its energy during just a few hours of the day, even if it accounts for a moderate share of the power grid’s annual energy — say 20 percent — it can account for an enormous share of instantaneous power in the middle of the day (in some cases, up to 100 percent). That high share magnifies the value deflation effect during those hours. Shayle Kann at GTM Research and I have surveyed the early evidence of value deflation around the world, as well as various economic models of how bad it could get in the future. It turns out that solar can lose more than two-thirds of its value when it provides one-third of a region’s electricity.[6]

That’s bad news, because in order to enable a decarbonized power system by midcentury, the world desperately needs solar to provide around one-third of global electricity. But even before it achieves such a high penetration, solar power will rapidly become worthless. Our research shows that the ongoing cost declines of existing silicon solar technology are unlikely to outrun the rapid erosion of solar’s value as more of it connects to the grid.

Most parts of the world may not experience solar value deflation for several years. That delay makes it especially dangerous, as the seeds of value deflation are unwittingly sown with effects that will become stark only down the road. Rapid solar deployment today may invite breathless projections of exponential growth, but solar’s trajectory is also consistent with logistic growth (known colloquially as an “S-curve”). In this kind of trajectory, solar’s rise would peter out in a couple of decades as it hits a penetration ceiling well before reaching the midcentury target of a third of global demand. Panel A in Figure 2 plots one study’s grim scenario of logistic growth, in which the combined capacity of solar and wind power level off after 2030 at only around 10 percent of the world’s electricity needs.

Panel B shows that of the five countries with some of the largest shares of electricity from solar PV, four — Italy, Greece, Germany, and Spain — have already seen their shares plateau after they reached 5–10 percent. (The fifth country, Japan, did not experience a slowdown in solar growth in 2016, although it had reached only 5 percent solar penetration.) The clearest exception to the trend of slowing solar growth is California — a country-size economy — where solar has broken through the 10 percent barrier to supply nearly 14 percent of the state’s electricity in 2016.[7] Nevertheless, warning signs that solar’s rise may be unsustainable are emerging even in California. If countries, especially in the developing world, experience a slowdown in solar growth similar to that seen in Europe, the world’s slim window to decarbonize the power sector will slam shut.

Figure 2: Exponential and logistic growth for renewable energy

In Panel A, the plotted points through 2017 represent the actual installed capacity, in gigawatts, of global wind and solar power installations. The dashed lines are exponential and logistic extrapolations of the trend that best fit the existing data. Both extrapolations pass through the value in 2020 that was the average prediction from a group of experts. Panel B displays the share of electricity from solar PV over the decade from 2006 to 2016 in five countries with some of the highest solar penetrations in the world. Source: Panel A adapted from Hansen et al. (2017); Panel B generated from data in BP Statistical Review (2017).

To a limited extent, the falling cost of battery storage might mitigate solar’s value deflation. But batteries can’t come close to satisfying the storage required to buffer a highly volatile energy source that accounts for one-third of global electricity. So a panoply of other approaches will be needed to ensure that it continues to make economic sense to deploy more solar power, even as its penetration rises around the world.

One option is to drive down the cost of solar energy even faster, to prolong the period before solar’s crashing value undercuts its cost. That will likely take new technologies that look radically different from today’s heavy, rigid solar panels. Emerging technologies in the laboratory might one day enable flexible, lightweight, and highly efficient solar coatings that are dirt cheap and possible to deploy in a much wider range of settings.[8]

Yet even dirt-cheap solar will suffer from value deflation as a result of its intermittent nature. A complementary approach to integrating gobs of solar power will therefore be to reconfigure and revamp the existing electricity system. Expanding electricity grids across continents and making grids much smarter will help. Ensuring that volatile solar is surrounded by a dependable and flexible supporting cast of power plants will also be essential.

The most promising candidate to flexibly provide zero-carbon power to accommodate intermittent solar is nuclear power. Nuclear reactors can ramp their output up and down to help the grid balance supply and demand — in fact, they have done so in France for decades.[9] But today’s light-water nuclear reactors are expensive and — in extremely rare circumstances — vulnerable to meltdowns or other accidents. Newer designs (actually based on ideas shelved decades ago), known as Generation IV nuclear reactors, could be cheaper, safer, and extremely flexible at modulating their output to compensate for fluctuating renewable energy output.

Innovation in both solar and nuclear is therefore critical to ensuring that solar’s rise does not stall. The problem is that nuclear has been mired in technological stagnation for decades, and solar appears to be following in nuclear’s footsteps.

3.

The solar industry as a whole takes a dim view of innovation. In other industries, such as the semiconductor industry from which solar descended, Intel and other large corporations routinely spend up to 20 percent of their revenue on R&D. In solar, that figure is more like 4 to 7 percent for a US firm, such as First Solar, and around 1 percent for Chinese firms. Recently, both corporate and government funding for solar technology innovation has risen in China, but it remains well below US levels.[10]

Chinese firms secured their stranglehold on the solar industry at great cost, losing vast sums to wipe out manufacturers around the world (including a raft of innovative start-ups in Silicon Valley, two of which I worked for before they went belly up). They survived thanks to government largesse, but their access to subsidies is dwindling. Most firms are now focused on ruthless cost-cutting, from the upstream production of polysilicon to the downstream deployment of silicon panel–based installations. And because the factories that make solar panels carry a high price tag, firms are reluctant to change course once they sink large amounts of capital into the ground.[11]

This tendency puts the industry at risk of technology lock-in, entrenching the dominance of silicon solar PV. Economic theories of lock-in suggest that an incumbent, dominant technology has the advantage over emerging technology upstarts. Even if upstarts hold the potential to cost less and perform better upon further development and scale production, they may flounder in a free market that favors first movers.[12] By 2030, the cost of electricity from silicon solar PV projects could halve, making silicon an even more formidable incumbent. Although far superior technologies would be even cheaper, efficient, and more versatile if they were commercialized, the world might find itself stuck with only incrementally better silicon panels. Those silicon panels might not be up to the task of overcoming the most problematic case of lock-in — namely, the world’s dependence on fossil fuels.

Every year solar panels get cheaper, but the gains are wrung from incremental optimization of manufacturing lines and supply chains, not breakthroughs in the lab.

Might lock-in be happening right now? There is no way to tell. Silicon may fall more rapidly in cost than currently anticipated, and value deflation might turn out to be less severe than today’s best simulations suggest. And if indeed solar is destined for lock-in, that will become clear only in retrospect. That was the case for nuclear power, for which it’s now possible to point to the fateful decision that led to disastrous lock-in.

Following World War II, US Navy admiral Hyman Rickover chose one of several potential nuclear reactor designs being investigated at the time — the light-water reactor — to power American submarines. Because the design worked, he chose it again to power aircraft carriers and, ultimately, civilian nuclear power plants.[13] The rest of this story of path-dependence is history. Today over 90 percent of all nuclear plants around the world are light-water reactors, owing to aggressive US export and nonproliferation policies in the 20th century. Never mind that these reactors can melt down and are expensive to build, nor that several of the other designs that Admiral Rickover passed over might be better options but have been stymied to date because of the dominance of the light-water reactor.[14]

Some signs suggest that solar power could be headed toward a nuclear-like lock-in. The fall in silicon solar panel prices is beneficial in the short term. But the drop makes it harder for emerging technologies, which might not be cost-competitive before economies of scale kick in at mass production, to break into the market in the long run.

What’s more, silicon solar projects can increasingly tap into public capital markets and access cheap finance, thanks to the existence of decades of performance data and 30-year manufacturer warranties. That ability adds another cost advantage to silicon over emerging technology competitors that public investors, having just gotten comfortable with silicon technology, are loath to bet on. In this sense, financial innovation can act as a barrier, rather than a bridge, to technological innovation.

Public policy can exacerbate lock-in as well. With nuclear, US regulations that were customized for light-water reactors have made it very difficult for firms to deploy new reactor designs. With solar, policies that are ostensibly technology-neutral implicitly tilt the playing field against emerging technologies. For example, developers building solar projects in the United States are much more likely to use federal tax credits to deploy silicon solar PV rather than try to build projects based on emerging technologies that may not yet be ready for prime time. State-level renewable energy mandates are similarly monopolized by silicon solar at the expense of emerging technologies. These policies expand silicon’s advantage and make it even harder to break into the market (not to mention the fact that they bizarrely exclude nuclear energy, with equivalent zero-carbon bona fides).

Well-intentioned public policies can also create political constituencies that work to entrench first-generation technologies. In the case of silicon solar, public policies such as federal tax credits have bred armies of lobbyists to ensure the extension of those policies.[15] They were successful in 2015, when Congress extended tax credits for both solar and wind power. To be sure, political coalitions that support silicon solar PV and other clean energy technologies are important forces behind a transition away from fossil fuels. Some scholars have argued that they might also be crucial players to pressure governments to pass carbon pricing policies, which enjoy widespread support from economists.[16] But in advocating narrow policy interventions that support mature clean energy technologies over emerging ones, these coalitions could also contribute to the kind of technology lock-in that has stalled nuclear power.

4.

After nuclear’s false start, the world is running out of time to switch over to clean energy. It doesn’t help that global energy transitions take many decades; as the energy scholar Vaclav Smil has pointed out, worldwide energy transitions — from wood to coal to oil — have each taken roughly half a century.[17] If the world can zero out its carbon emissions within a half-century, then it stands a chance of avoiding catastrophic climate change.[18] But if that transition sputters by midcentury, there will be no opportunity for another do-over.

Avoiding that outcome will require freeing both solar and nuclear energy from technological lock-in. Public policy has an important role to play in promoting that energy innovation. Private investors are often skittish about funding a novel solar material or nuclear reactor design that can take a decade or more and huge sums of capital to deploy commercially. Policy makers should help fill this gap by ramping up spending on R&D, funding first-of-their-kind field demonstration projects, and making it easier for private firms to use public research facilities to reduce the costs of developing new technologies.[19]

Innovation in both solar and nuclear is critical to ensuring that solar’s rise does not stall.

The United States has the world’s most advanced facilities and richest history of energy innovation, so its leadership is essential to developing the next generation of energy technologies. Under President Obama, the United States committed to lead the world in funding energy innovation, doubling its federal research and development budget. Unfortunately, the Trump administration has turned that pledge on its head, aiming to slash energy innovation funding in half. This course will not only jeopardize the world’s chances of confronting climate change; it will also ensure that China will be the one to increase its market share across clean energy technology industries and reap the rewards of dominance in rapidly growing sectors.

Much has been made of the gradual decline of nuclear energy and the startling ascent of solar. Many infer that solar energy has arrived and is ready to power a renewable energy revolution that displaces fossil fuels and replaces clean but unsavory nuclear energy. This view is dangerously misguided. Solar energy may well be the star of tomorrow’s energy system, but it will require a strong supporting cast, most notably in nuclear.

On the other hand, if it succumbs to technology lock-in, solar energy could ultimately follow in nuclear’s footsteps, peaking well before meeting the world’s breathless expectations. Countries — beginning with the United States — would do well to heed the lessons of history and invest more proactively and inclusively in a clean energy future.

Read more from Breakthrough Journal, No. 8

Featuring pieces by Charles Mann, Steven Pinker,

Jonathan Symons, Tisha Schuller, Jenny Splitter,

and Ted Nordhaus.

[1] 1954. “Vast Power of the Sun Is Tapped by Battery Using Sand Ingredient.” New York Times (April 26), http://www.nytimes.com/packages/pdf/science/TOPICS_SOLAR_TIMELINE/solar1954.pdf.

[2] Eisenhower, D. D. 1953. “Atoms for Peace.” Speech delivered at the 470th Plenary Meeting of the United Nations General Assembly (December 8), https://www.iaea.org/about/history/atoms-for-peace-speech.

[3] Strum, H. 1984. “Eisenhower’s Solar Energy Policy.” The Public Historian 6.2 (Spring): 37–50.

[4] National Research Council, et al. 1972. Solar Cells: Outlook for Improved Efficiency. Washington, DC: The National Academies Press.

[5] Thuan, N. K. 1982. “Telecommunications Power in Australia.” Presentation at the International Telecommunications Energy Conference, Washington, DC: 395–401.

[6] Sivaram, V., and S. Kann. 2016. “Solar Power Needs a More Ambitious Cost Target.” Nature Energy 1.4 (April 7), https://doi.org/10.1038/nenergy.2016.36.

[7] Penn, I. 2017. “California Invested Heavily in Solar Power. Now There’s So Much that Other States Are Sometimes Paid to Take It.” Los Angeles Times (June 22), http://www.latimes.com/projects/la-fi-electricity-solar/.

[8] Sivaram, V. 2017. “Can India Save the Warming Planet?” Scientific American (May), https://www.scientificamerican.com/article/can-india-save-the-warming-planet/.

[9] Grubler, A. 2010. “The Costs of the French Nuclear Scale-Up: A Case of Negative Learning by Doing.” Energy Policy 38.9: 5174–5188, https://doi.org/10.1016/j.enpol.2010.05.003.

[10] Ball, J., D. Reicher, X. Sun, and C. Pollock. 2017. The New Solar System: China’s Evolving Solar Industry and Its Implications for Competitive Solar Power in the United States and the World. Steyer-Taylor Center for Energy Policy and Finance, Stanford University (March 20).

[11] Powell, D. M., et al. 2015. “The Capital Intensity of Photovoltaics Manufacturing: Barrier to Scale and Opportunity for Innovation.” Energy and Environmental Science 12, http://pubs.rsc.org/en/Content/ArticleLanding/2015/EE/C5EE01509J.

[12] Arthur, W. B. 1989. “Competing Technologies, Increasing Returns, and Lock-In by Historical Events.” The Economic Journal 99.394: 116–131, https://doi.org/10.2307/2234208.

[13] Cowan, R. 1990. “Nuclear Power Reactors: A Study in Technological Lock-in.” Journal of Economic History 50.3: 541–567, http://www.jstor.org/stable/2122817?origin=JSTOR-pdf.

[14] Sivaram, V. 2017. “Unlocking Clean Energy.” Issues in Science and Technology 33.2 (Winter), http://issues.org/33-2/unlocking-clean-energy/.

[15] Victor, D. G., and K. Yanosek. 2011. “The Crisis in Clean Energy: Stark Realities of the Renewables Craze.” Foreign Affairs (July), https://www.foreignaffairs.com/articles/2011-06-16/crisis-clean-energy.

[16] Meckling, J., et al. 2015. “Winning Coalitions for Climate Policy.” Science 349, https://doi.org/10.1126/science.aab1336.

[17] Smil, V. 2017. Energy and Civilization: A History. MIT Press.

[18] 2014. Climate Change 2014 Synthesis Report: Summary for Policymakers. Intergovernmental Panel on Climate Change, http://www.ipcc.ch/pdf/assessment-report/ar5/syr/AR5_SYR_FINAL_SPM.pdf.

[19] Sivaram, V., T. Norris, C. McCormick, and D. M. Hart. 2016. “Energy Innovation Policy: Priorities for the Trump Administration and Congress.” Information Technology and Innovation Foundation (December 13).