US-China Climate Deal Underscores Need for Substantial Energy Innovation

China to Add More Electric Power From Coal Than From Nuclear, Wind, or Solar

-

-

Share

-

Share via Twitter -

Share via Facebook -

Share via Email

-

Talks at the UNFCCC COP20 in Peru undoubtedly have been buoyed by the recent US-China Joint Announcement on Climate Change. While the pledges by the two largest players may represent a veritable political breakthrough, a new Breakthrough analysis of China’s energy plans shows there is reason for concern. Despite unprecedented efforts, China will likely replace existing coal consumption with more new coal power generation than that from new nuclear, or from new wind and solar power generation combined.

This sobering reality makes it all the more clear that international efforts to accelerate the pace of low-carbon energy innovation will be needed to achieve the deep CO2 reductions necessary to mitigate climate change. As two Google engineers argued in IEEE Spectrum last month, clean energy not only needs to be preferable to new coal; it will need to undercut existing coal in order to make any serious dent in present-day emissions. China’s clean energy deployment targets reveal how unresolved the technological challenge of mitigating climate change really is.

1) China’s (and US’s and EU’s) Clean Energy Targets Expose Slow Pace of Energy System Decarbonisation

In response to the US-China announcement, Glen Peters of the Global Carbon Project has shown how the new Chinese emissions targets, as well as those of the United States and European Union, maintain a trajectory that reflect current trends and existing policies, with the implication being that these scenarios will most likely result in more than 2 degrees Celsius of warming.

In Figure 1, it is clear that China’s new commitment to 20% non-fossil primary energy consumption by 2030 is also quite consistent with existing trends, policies, and targets.

Figure 1.

As part of its Energy Development Strategy Action Plan for 2014-2020, China recently made a 15% non-fossil energy target by 2020 official. This 15% by 2020 goal, however, had already been promised 9 years ago by President Hu Jintao. Despite substantial cost reductions in renewable power technologies, fast-growing dependency on fossil fuel imports, and suffocating air pollution that has become impossible to ignore, the Chinese government signalled that it could only pledge another 5% by 2030.

Meanwhile, in the United States, which does not have a national clean energy target, the EPA Clean Power Plan will not make much of a dent in the US fossil-based energy system, with the displacement of coal by natural gas and efficiency driving almost all of the expected 28% reduction from 2005 GHG emission levels. With additional expected growth in renewables, this puts the US non-fossil share of energy at around 19%. In the EU, aggressive efficiency and renewables deployment targets along with nuclear fleet maintenance (EU-wide) is expected to improve the EU’s non-fossil share to 33% by 2030.

These trends should be contrasted with the 70 to 100% proportion of very-low-carbon primary energy needed by 2050, as prescribed by almost every scenario that is intended to avert extreme climate change, shown in Figure 1. These woefully low clean energy trajectories and targets indicate that the currently dominant strategy of renewables deployment will not be enough to get China or the world anywhere near a fossil-free energy future anytime soon.

2) Nuclear Will Carry the Largest Load in China’s Clean Energy Additions Through 2030

Numerous commentators have mistakenly referred to China’s 20% target as a renewables pledge, crediting the readiness of renewable energy. While renewable power will contribute significantly to a successfully decarbonized energy system, nuclear power will play the leading role, according to analysis based on China’s Energy Development Strategy Action Plan.

Pre-2011 plans had China’s nuclear power capacity at 100 GW by 2020 and 270 to 320 GW by 2030, according to initial proposals noted by the World Nuclear Association, but the Fukushima accident resulted in a halt in approvals and delays in construction plans. China’s multiyear post-Fukushima review of its nuclear ambitions have resulted in recalibrated plans that call for an accelerated transition to Generation III models, which will further delay plans, but re-affirm China’s long-term commitment to a colossal deployment of nuclear power.

In the latest Energy Development Strategy Action Plan released November 2014, China confirmed a target of 58 GW installed by 2020 and another 30 GW under construction by that time. There are no official 2030 targets yet, but the World Nuclear Association notes that there are 66 GW of nuclear reactors in site-specific construction plans filed with the Chinese regulatory authorities due to be completed by 2025, and another 155 GW in proposals for construction between 2020 and 2035.

Due to the post-Fukushima review, it is likely that some of these plans will not have borne fruit by 2030, but the National Development and Reform Commission is making it clear that approvals for nuclear construction will resume quickly. The latest estimates for Chinese nuclear capacity in 2030 include Wood Mackenzie (April 2014) with a revised estimate from 200 GW to 175 GW by 2030, World Nuclear Association (December 2014) estimating “150 GW by 2030, and much more by 2050,” and the International Energy Agency’s latest 2014 World Energy Outlook New Policies Scenario estimating 114 GW by 2030 and 149 GW by 2040 (but China notably failing to reach 20% non-fossil energy by 2030 in this scenario), the IEA WEO High Nuclear Case estimating 154 GW by 2030 and 195 GW by 2040, and the IEA WEO 450 Scenario estimating 164 GW by 2030 and 236 GW by 2040.

Breakthrough’s analysis incorporates China’s 15% and 20% targets, explicit 2020 targets for nuclear, hydro, wind, solar, and bioenergy, and 2030 capacities based on a 150 GW nuclear capacity target and generous targets for renewables (400 GW of wind, 300 GW of solar). The results in Figures 2 show that every non-fossil energy source (except hydro) will need to deploy at historically unprecedented rates to meet the 20% target by 2030.

Figure 2.

Firstly, China will need to build the largest fleet of nuclear power plants in history –– 131 GW worth of nuclear reactors –– in the next 15 years. For comparison, the United States deployed a total of 112 GW of nuclear power between 1957 and 1996.

However, it is also useful to consider that nuclear construction and deployment has historically occurred in remarkably compressed timeframes. The United States recorded additions of 10 GW in 1974 alone; 38 GW of nuclear power between 1972 and 1976; 33 GW between 1984 and 1987; and a total of 93 GW between 1972 and 1987, despite major nuclear accidents that led to delays and reviews. France deployed more than 7 GW in both 1981 and 1986, and a total of 42 GW between 1980 and 1987.

China has a significantly larger industrial base and economy today than did either the US or France in the 1980's, and has two decades of experience building nuclear plants. As of December 2014, China already has 19 GW of nuclear power connected to the grid and another 26 GW under construction. Put in this context, China’s targeted nuclear deployment rates, while unprecedented, are not unimaginable, especially considering historic coal power deployment rates and substantial commonalities between nuclear and coal plants.

As for wind and solar, both technologies will need to install at rates higher than 2014’s record amount of capacity additions, every year, until 2030, despite deep cuts to wind and solar subsidies mandated in China’s energy plan. In addition, large and small hydropower will need to continue to expand steadily, despite signs of site saturation and the social and environmental costs brought to light by the Three Gorges Dam experience. Only all of this new capacity together, shown in Figure 3, will allow China to meet its 20% target for clean energy.

Figure 3.

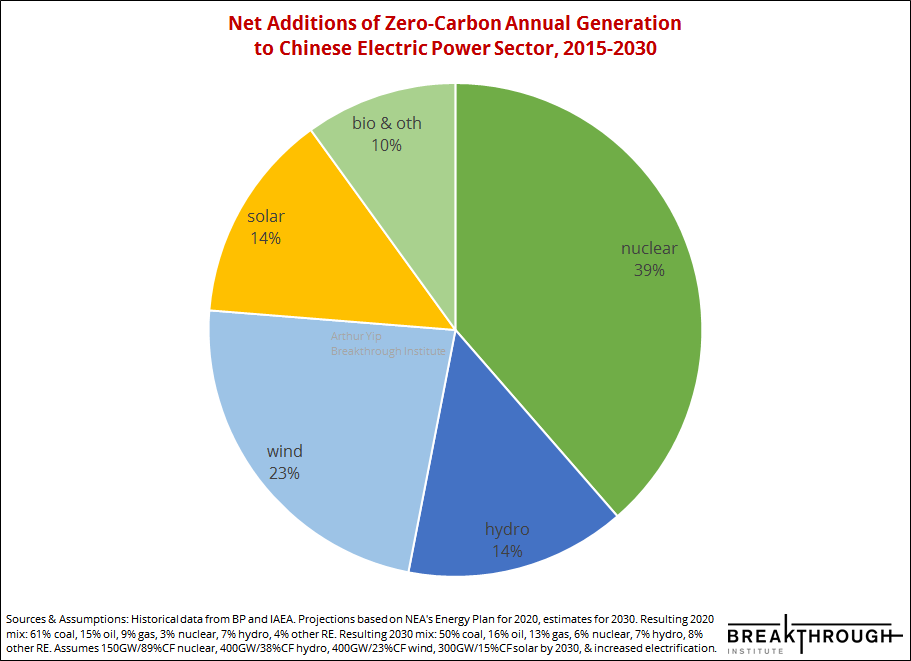

The role of nuclear power is even clearer when actual electrical generation is considered rather than generation capacity, because a nuclear power plant produces three to five times more electricity than that from the same installed capacity of wind or solar power over an entire year. Accounting for average Chinese capacity factors, Figures 4 and 5 show that China will rely on nuclear for 39% of its new clean energy production to meet its 20% by 2030 target, which is more than wind’s (23%) and solar’s (14%) combined contribution.

Figure 4.

Figure 5.

3) Despite Unprecedented Clean Energy Additions, China Will Continue to Add Large Numbers of Fossil Fuel Power Plants

While China’s clean energy additions will indeed be historic, China fully intends to continue deploying staggering amounts of fossil energy at the same time, based on still-growing energy needs that are not met by clean energy. In China’s Energy Development Strategy Action Plan for 2014-2020, fossil fuels receive prominent billing. Domestic coal mines and “coal energy corridors” are slated for expansion, in order to bring coal-fired electricity and coal-derived synthetic gas produced in western regions into eastern cities. These schemes explain how China will clean up conventional air pollution in wealthier areas and how China will reduce and perhaps eliminate the need to import coal, while continuing to generate massive amounts of CO2 from coal.

Upper limits for coal consumption are specified within the energy plan’s timeframe (4.2b tonnes/year, 11% higher than 2013 consumption, and 62% primary energy consumption), but Bai Jianhua of the China State Grid Research Institute warns that even as heavy industry such as steel and cement slow their growth, reductions in coal consumption in industry could end up being replaced by coal burned for electricity, resulting in a potential addition of 600 GW of coal-fired power plants by 2035. Bloomberg New Energy Finance’s The Future of China’s Power Sector 2013 white paper forecasted additions of 343-450 GW of coal power between 2013 and 2030 in its range of scenarios. Old, inefficient, and dirty home heating stoves, boilers, industries, and power plants will be shut down in designated regions, but new efficient coal-fired power plants with scrubbers will sprout up elsewhere. Catherine Wolfram of UC Berkeley describes how poor air quality could lead to increased demand for air conditioning. I further hypothesize that poor air quality encourages uptake of personal vehicles and discourages walking, biking, or public transport.

In addition, natural gas has an explicit target for dramatic expansion, from 5% in 2013 to 10% of primary energy consumption by 2020, which will also contribute to air quality improvements. As such, it is evident that China expects fossil fuels to remain fundamental building blocks of its energy system, even after consideration of the latest price reductions in new technologies and the extremely poor air quality. Breakthrough’s modelling results suggest that new coal power capacity additions between 2015 and 2030, at approximately 300 GW, will rival new additions in wind and solar capacity, and greatly exceed new additions of nuclear capacity, shown in Figures 6 and 7.

Figure 6.

Figure 7.

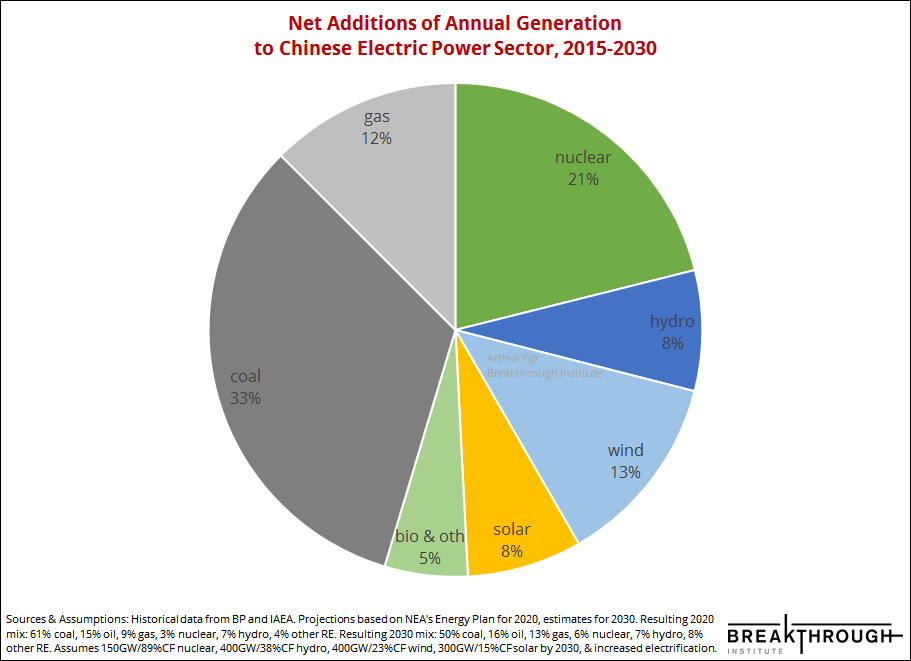

When one considers the actual expected contributions to new electricity generation as opposed to generation capacity, it is even clearer that coal will continue to factor strongly in new electricity generation, and therefore retain its dominance in China’s electric power sector in the long term. Shown in Figures 8 and 9, new coal power could generate one-third of the new electricity generation in China between 2015 and 2030, while nuclear supplies about one-fifth, and solar and wind together supply another fifth.

Figure 8.

Figure 9.

4) The Big Picture

When put all together and with consideration to the entire energy system, including non-electric energy in industrial, transportation, commercial, and residential use, the targeted growth in China’s non-fossil energy will not be enough to meet energy demand growth, much less displace existing fossil-based energy. There is limited expansion room for hydropower, which is predicted to steadily grow but remain at today’s 7%. Even with nuclear, growing from 0.9% to 6%, and wind, solar, and bioenergy, together growing from 1.5% to 8% –– all deployed at “Chinese-speed” –– China’s energy demand, even after strong efficiency efforts, remains too much for today’s clean energy technology to handle, as seen in Figure 10.

Also notable in Figure 10 is the trajectory of coal, which appears likely to approximate the “long, high plateau” that the Clean Air Task Force recently warned of, rather than a much-vaunted "peak." Figure 11 reminds us where scenarios tell us clean energy needs to be in 2050 for 2 degrees C and how far China is from there. Also, compare Figure 10 with the oft-cited “climate stabilization wedges” prescribed by Pacala and Socolow, and it should be obvious that a deep transformation of the present fossil energy economy is not on the horizon in China.

Figure 10.

Figure 11.

Conclusion

China’s 20% non-fossil energy target is a continuation of current trends and policies and reflects the naturally slow pace of energy transitions. Of the 20% target, nuclear power is expected to carry the largest load in terms of new clean energy generation. Though it should be self-evident, a 20% fossil-free energy system is 80% fossil-dependent, which means massive amounts of carbon dioxide emissions for decades to come. At the same time, the 20% target is ambitious. China will need to deploy both unprecedented amounts of renewables capacity and the world’s largest fleet of nuclear power plants to get to 20%.

Given that 20% is a long way from a successfully decarbonised energy system, China’s 20% target signals to the world that currently available technologies are simply not good enough and that technological development and innovation are still desperately needed and remain key to success. For the world to actually move forward on climate, we will need a whole lot more research and development, innovation, and demonstration of all alternative energy technology options to make energy clean and cheap. Coal is the common enemy and it has yet to be defeated globally at any relevant scale. An all-hands-on-deck approach that embraces nuclear, advanced coal, and further energy innovation is truly needed.

Fortunately, China may also be showing us the way forward. The most important part of the US-China announcement may not be the targets for emissions or clean energy, but the provisions for energy innovation and technology cooperation, which include:

- Joint Clean Energy Research and Development on building efficiency, clean vehicles, advanced coal technology, and the energy-water nexus;

- Major Carbon Capture, Utilization, and Storage Demonstrations, including a "Enhanced Water Recovery" (EWR) pilot project;

- Pilot and demonstration projects in the areas of building efficiency, boiler efficiency, solar energy, and smart grids; and

- Continued cooperation on advanced coal technologies, nuclear energy, shale gas, and renewable energy.

The announcement also discusses improved trade in green goods. The benefits of mass manufacturing and deployment of wind turbines and solar panels in China are widely recognized; conversely, not enough attention has been paid to how China has become the world leader in nuclear technology research, development, innovation, demonstration, and deployment. Post-Fukushima, China re-affirmed its commitment to becoming a “world leader” in nuclear power, reflecting an industrial strategy to leap from follower to leader by engineering “major technological breakthroughs.”

On the deployment front, China has been building nuclear reactors and prototypes of all types and models in the world, spanning from tried-and-true designs from France, Russia, and Canada, the latest Westinghouse AP-1000 and AREVA EPR reactors, to multiple indigenous designs that have evolved to meet international Generation III standards. In December 2014, the ACP-1000 became the first Chinese-designed reactor to successfully pass the International Atomic Energy Agency’s Generic Reactor Safety Review. China has been developing expertise and supply chains to roll out the standardized AP-1000 design, the CAP-1400 indigenous evolution of the AP-1000, and the Hualong 1, the latest indigenous Chinese design evolved from the ACP-1000 and ACPR-1000.

Furthermore, China has been experimenting with advanced Generation IV reactor technologies, which are safer and cheaper by design, and has started to demonstrate them at scale. Novel nuclear technologies in China’s world-leading R&D portfolio include High Temperature Gas-cooled Reactors, Sodium-cooled Fast Reactors, Molten Salt Reactors (pebble bed, and molten-salt-fuelled), Supercritical Water-Cooled Reactors, and advanced fuel reprocessing and thorium fuel use based on heavy water CANDU reactor technology. The world’s first scaled-up commercial HTGR at 200 MW is under construction, due for completion by 2017. The China Experimental Fast Reactor, 20 MW, has been connected to the grid since 2011, and China has signed a contract with Russia to deploy a pair of BN-800 fast reactors at Sanming by 2023.

With all this R&DDD activity in clean energy, China is proving its intention to lead the high-energy innovation needed for the world to break free from fossil fuel energy and mitigate climate change successfully.

Photo Credit: Redlatinastl.com (left); TotallyCoolPix.com (right)