Uninformed Nuclear Pessimism

-

-

Share

-

Share via Twitter -

Share via Facebook -

Share via Email

-

Economist and blogger Noah Smith recently argued that, while nuclear fission had its time, the “nuclear ship has sailed.” Long an avid supporter of solar energy, Smith posits that price reductions for solar power and battery storage have foreclosed nuclear energy’s future—a reality that nuclear advocates must accept.

Smith identifies issues that contribute to higher costs—regulation, TMI, interest rates, etc—and then brushes them aside. You could also add quality control standards that are not world standards, and often of lower quality. This reduces the available supply chain, increasing cost and risk of delays. The impact of regulation isn't simply direct regulatory costs, but a market barrier to the innovation necessary to reduce costs, benefits incumbents and raises barriers to market entry. Multiple strong bipartisan bills to address regulatory obstacles will take time to implement.

As an economist you would think that he would avoid major pitfalls such as looking for causation when there are clear confounding factors, but not here. Every example is held up as proof. He mentions the important relationship of technology to society and techno-optimism vs. pessimism, and then immediately disregards that, falling into a narrative of his own optimism for solar and pessimism for nuclear.

Is that pessimism warranted? No. All of Smith’s data are old and related to technologies from generations ago. And some of his assertions are just wrong. Large light water reactors can be built on time and on budget. He even showed that in an example from China. Korea and the United Arab Emirates have also built large light water reactors on time and on budget, with markets that are very different from China. Many countries have individual commitments to build more nuclear energy, and triple nuclear energy globally.

Smith doesn't know the more recent technology, and doesn't appear to want to. He says that in-situ construction is a driver for higher costs. This is generally true, but much less relevant for new factory built modular plants, which he completely ignores. In addition to factory construction addressing manufacturing costs, it reduces project risk. Accumulated interest and workforce costs during delays at conventional nuclear plants with large civil works are key drivers of cost overrun.

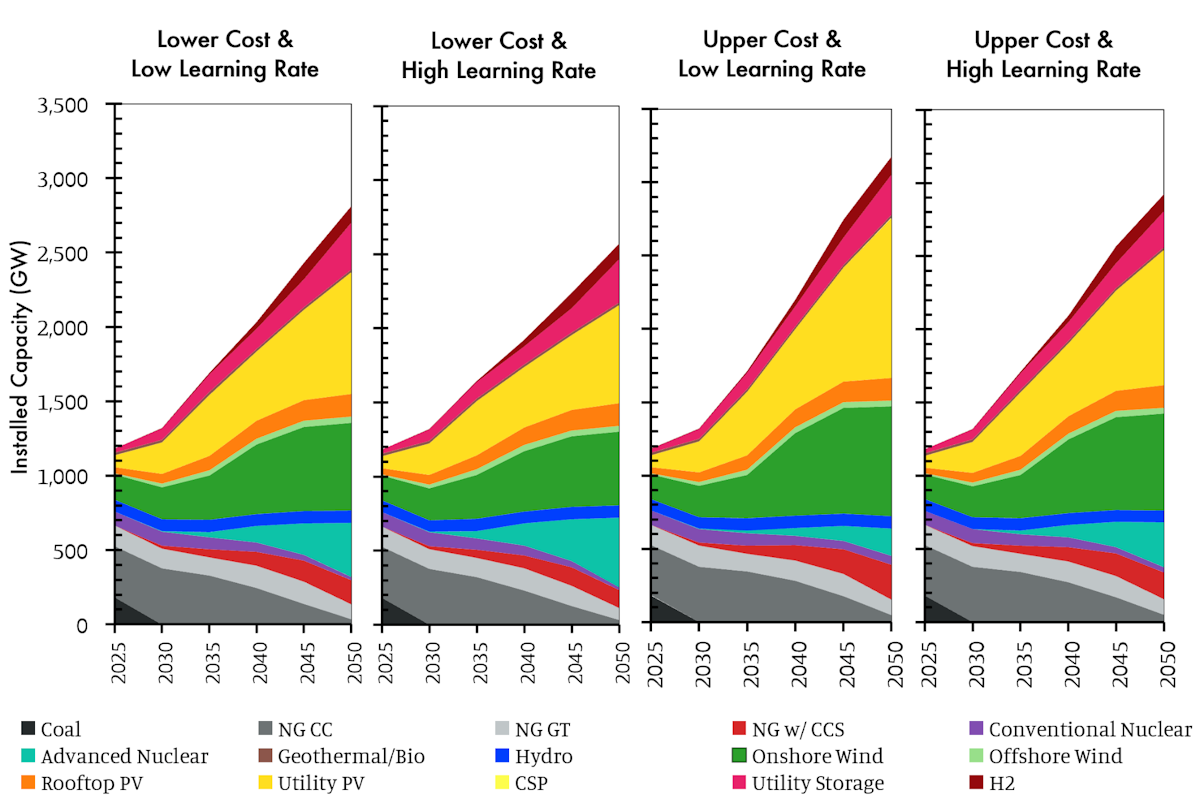

Smith brings up learning curves, but again is behind on the research. Breakthrough is constantly testing our own assumptions and bias by doing our own research. We looked at learning rates for nuclear and other technologies in our Advancing Nuclear report, which has become the basis for other recent reports considering learning rates instead of assumed costs, including the DOE liftoff report. Our report considers bounding scenarios of high and low costs, and high and low learning rates. This bounding approach gives more confidence that real world outcomes will be within these bounds, unlike typical scenario approaches. We find that even at very high costs and with little learning, we need to almost double our current nuclear capacity in the US for a low-cost, reliable, decarbonized electricity system.

More recently, I worked on a report with Idaho National Laboratory, Argonne National Laboratory, and researchers at the Massachusetts Institute of Technology that dug even deeper on learning and costs, which has become the basis for NREL's Annual Technology Baseline on nuclear and all models that use that database.

Past performance is not a perfect indicator of future success. If it was, innovation would be useless. In fact, by Smith’s logic, solar should have been abandoned decades ago when it could not come close to reaching cost-competitiveness with other energy technologies. But, that would have been a bad outcome overall. Costs did finally drop for solar as new enabling technologies were developed.

Our Advancing Nuclear report finds that nuclear energy will not be the majority of energy production. But it can provide clean, firm power that is extremely important to the grid, even at very high bounding costs with low learning. Every grid region has a variety of energy sources, which operate at different prices for a reason. They provide different attributes and are dispatched by the market at different times. The market won't allow for a monoculture of energy because the participants would have no way to make money. If all solar costs the same, which is dispatched when? If prices are pushed to the floor, how do they make money? Which facility gets curtailed during the daily peak? Smith’s argument also ignores the function of the grid. We need inertia and frequency response, firm power, grid connections to each facility, and more. Grid planners give solar with storage credit for a small fraction of the nameplate capacity in reliability planning because it isn't firm. Smith’s conclusion to "overbuild solar a bit" is naive of the engineering involved to make a solar-heavy grid work; this isn't as simple as saying the panels are cheap, so use them.

Smith’s point that "France's nuclear energy is greener than America's, but it's not more abundant" doesn't make sense, no matter how you look at it. Energy consumption compared between the two countries doesn't matter here. France didn't build double the nuclear capacity they have, because they didn't need to.

France has more energy than it needs and sells it to other countries in Europe. They have abundant energy. Their costs are a bit higher for three reasons. First, France sells their excess energy to other countries and makes money. Companies sell the power as high as possible to make a profit regardless of operating cost—a concept an economist should take as a given. Second, France reprocesses its spent fuel which addresses Smith’s main concern about nuclear (waste) but adds to the cost. And if you want to compare with other technologies, no other energy sources manage their waste. And finally, American electricity prices are low because cheap natural gas drives down the cost of energy.

On China, again, his data are old. China has 30 reactors under construction and just approved construction permits for 11 more last month. They plan to add 10-14 reactors per year by 2030. Their approach to construction is hard to duplicate elsewhere, especially in the US, because they optimized their design to increase labor hours and decrease component costs. This is due to the large workforce they have at low costs. Some large components are literally carried into place by 80 people instead of hoisting it. Also, as in the US, China doesn't need the majority of capacity to be from nuclear, just 15-30%.

Is nuclear too expensive? Not really, even at the unrealistic $0.155/kWh price he posted (again, old data specifically from Georgia’s Vogtle plant) it is marketable—less than half the price of CA retail rates, and less than current solar with storage prices. A lot of the CA prices is to pay for grid costs, which nuclear also reduces the need for. Operating plants cost a mere $0.03-$0.05/kWh to customers. Including nuclear energy in the mix reduces overall system costs, which reduces consumer rates.

From an environmental and public health standpoint, which should also matter, nuclear wins in almost every category—health risk, CO2 emission, land use, mining impacts and critical minerals, and more.

So yes, solar and battery costs are dropping, which is good. Our research and others suggest that the same can be true for nuclear, and 50 companies are working on designs to address past challenges. Other factors, too, including total system costs, will slow solar deployment at some point.