Will a Cold European Winter Exacerbate the Energy Crisis?

Despite the best efforts of politicians, no policy response will be able to replace the energy previously provided by Russian natural gas quickly, and this reality will come to a head in the winter.

-

-

Share

-

Share via Twitter -

Share via Facebook -

Share via Email

-

Until recently, Russia was the third largest producer of oil and the second largest producer of natural gas, feeding into European as well as global markets. In the wake of Russia’s invasion of Ukraine, the flow of these critical fuels out of Russia has declined dramatically thanks to state-level sanctions on Russian imports, voluntary bans on Russian gas among some companies, and most recently, Russia cutting off gas supplies as a hostage tactic.

The resulting decrease in natural gas supply is particularly consequential in Europe, where Russian gas has recently provided about one-third of the natural gas consumed. With limited supply, gas prices have spiked. Though winter natural gas futures prices are down from a truly extraordinary peak in early September (due mostly to good news on increased liquified natural gas import from other producers like the United States and storage), futures prices for the winter of 2022-2023 are still 4-5 times higher than they were at the same point in 2021 (Figure 1).

Since natural gas is the main source of heating and electricity in many European countries, accounting for about 40% of all energy consumed in the United Kingdom, for example, price spikes cause huge problems for industry, commerce, and residents alike.

In August, for example, the University of York calculated that extreme prices over the winter could lead to two-thirds of British families being in “energy poverty” by January. That means that they will be spending more than 10% of their income on energy. Industry analysts have likewise calculated that, at current market prices for natural gas, the United Kingdom might expect 70 hours this winter when the supply of electricity is unable to meet demand, causing large-scale brownouts.

Though there are fewer comprehensive studies available for the EU than for the United Kingdom, other European countries are facing much the same. And in response, they’ve enacted a plethora of measures, including expensive and possibly counterproductive price caps, limits on lighting and heating, and campaigns for public reductions in energy consumption (by, e.g., reducing shower lengths and hang drying clothes). Germany will likely take the drastic step of nationalizing three large gas importers.

How much will winter temperatures affect Europe’s energy woes?

Despite the best efforts of politicians, no policy response will be able to replace the energy previously provided by Russian natural gas quickly, and this reality will come to a head in the winter.

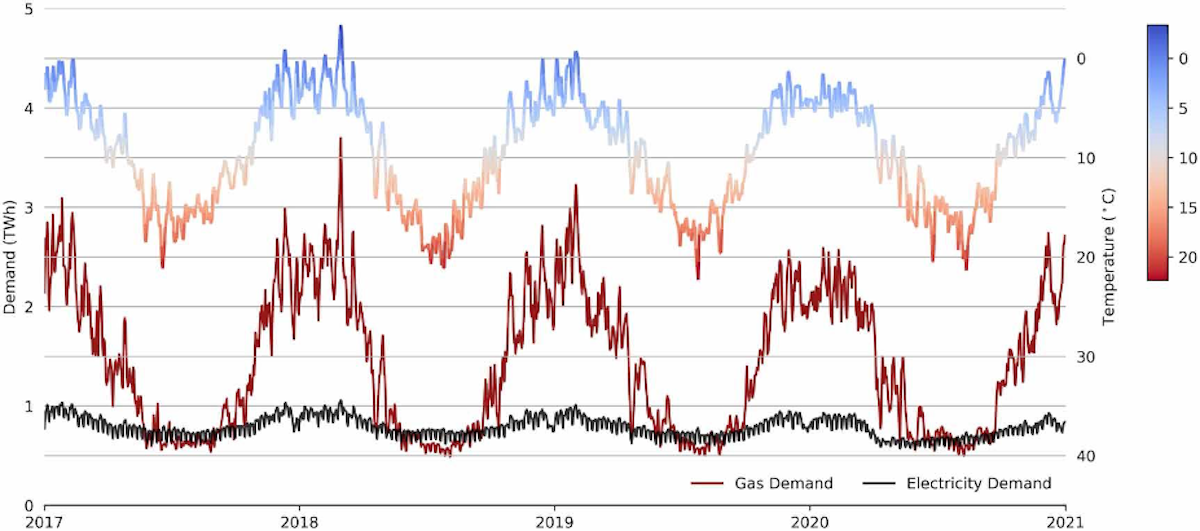

As a driver of demand for heating, temperature is by far the dominant factor in natural gas demand in Europe. In the United Kingdom, for example, gas demand is about four times higher in the winter than in the summer (Figure 2).

We know that natural gas demand will increase in Europe over the next several months as fall turns into winter. But exactly how cold this winter ends up being will make a big difference. For every 1°C variation in daily temperatures in the United Kingdom, electricity demand varies by about 1%, and gas demand varies by about 4%.

Average winter temperatures in the United Kingdom can differ by 3-4°C, meaning that gas demand can vary by about 15% from winter to winter. With supply so short, a difference of 15% could be the difference between widespread shortages or not. Shortages matter not just for the economy but also for human life. Under normal circumstances, cold temperatures are associated with about ten times more premature deaths than hot temperatures (Figure 3). In other words, cold is deadly even when energy is relatively cheap and accessible. However, when energy is much more expensive, cold will be even deadlier.

Will this upcoming European winter be milder because of climate change?

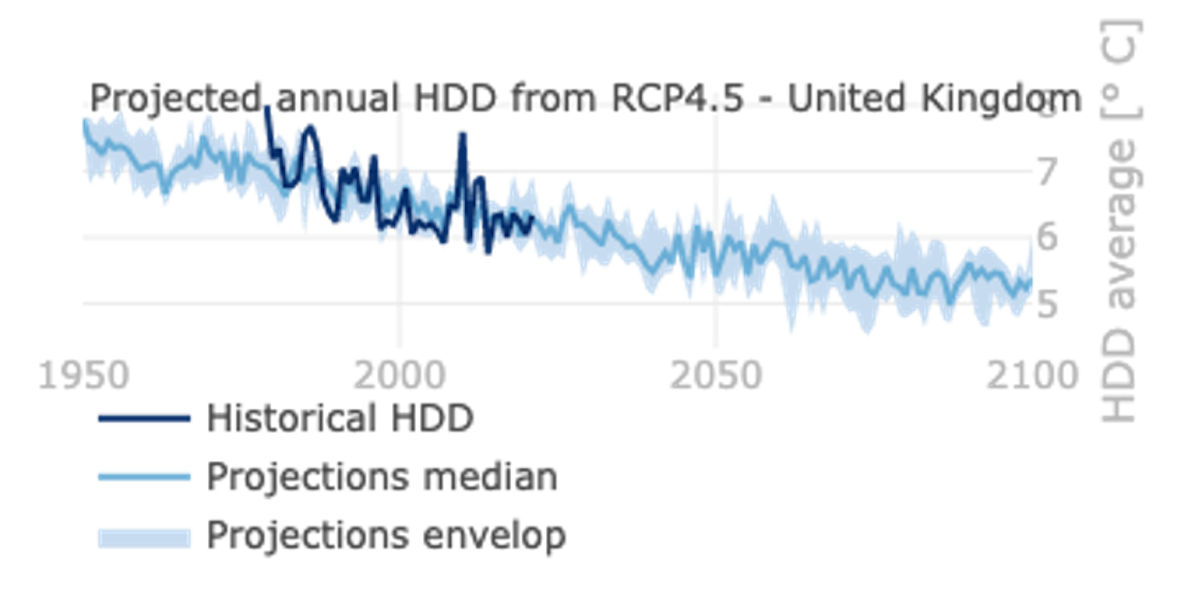

Well, the first piece of information to consider is that “normal” temperatures are changing. European winters have warmed by about 2°C since the industrial revolution, which implies a relaxation of gas demand by about 8% relative to what it would have been without climate change. This is consistent with a long-term decrease in British heating degree days from a mean of about 8 degree days (Celcius) per day in 1950 to about 5 degree days per day by the end of this century (under a middle emissions scenario, Figure 4).

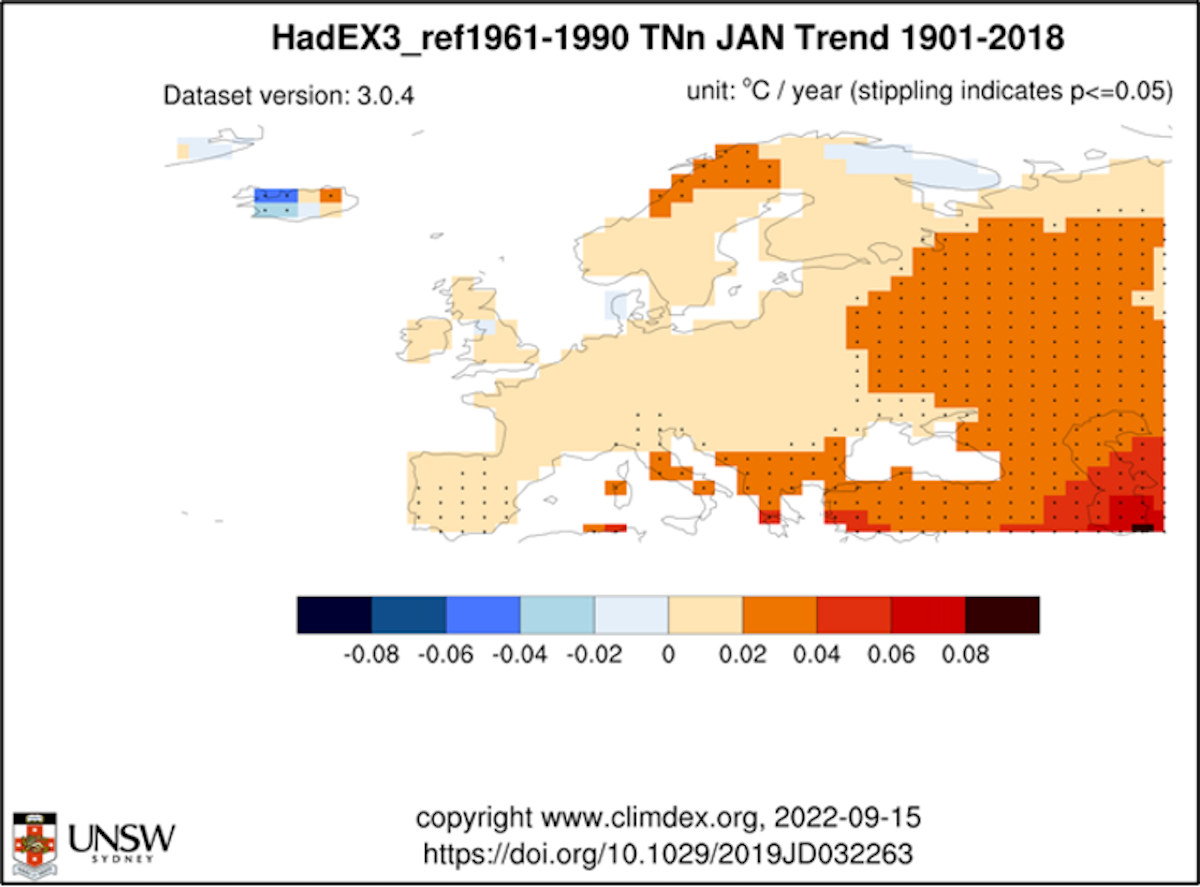

Of course, it’s not just average winter temperatures that must be considered. The occurrence of extremely cold days, even embedded within a relatively mild winter, can have an outsized impact on gas demand. Despite some confused reporting on the issue, the coldest winter days in Europe (and in the United States) have been getting warmer since 1901 (Figure 5). Overall, then, climate change is likely to save energy and lives in Europe this winter.

But there’s more to winter temperature variability than climate change, right?

Apart from climate change, “seasonal forecasting” can also help paint a clearer picture of what to expect for the upcoming European winter.

You may have noticed that daily weather forecasts typically extend 5-10 days into the future. This is for good reason. In the 1960s, the American mathematician Edward Lorenz discovered, or at least popularized, the butterfly effect, which essentially dictates that the predictability of the day-to-day sequence of weather approaches zero beyond a time horizon of a couple of weeks.

However, even though the day-to-day sequence of weather cannot be predicted beyond a couple of weeks, the state of the atmosphere averaged over time periods longer than a day (months to even decades) can be predicted with some skill. This is because the atmosphere is loosely constrained by some slowly varying processes in the climate system like patterns in sea surface temperatures, the conditions of continental vegetation, soil moisture, sea ice extent, and circulations in the upper atmosphere (called the stratosphere). These slowly-evolving parts of the climate system can cause the atmosphere to favor certain configurations over others, causing particular weather conditions to be more likely.

The most prominent example of a favored state of the atmosphere that affects European winter weather is known as the North Atlantic Oscillation. The North Atlantic Oscillation has two main phases, known as “positive” and “negative.” These phases either enhance or reduce the typical meteorological patterns of the region (Figure 6).

The North Atlantic ocean is a major source of heat and moisture in Europe in the winter. When the North Atlantic Oscillation is in its positive phase, there is enhanced transport of heat and moisture from the Atlantic Ocean into Northern Europe. When the North Atlantic Oscillation is in its negative phase, this flow is drastically reduced, and cold, dry air from the arctic becomes much more prominent over Northern Europe.

Consequently, the phase of the North Atlantic Oscillation has a direct and relatively strong association with gas demand in the United Kingdom. Meanwhile, the East Coast of the United States tends also to be warmer than average during the positive phase of the North Atlantic Oscillation. This means that gas demand in northern Europe and the eastern United States will often vary together, giving the North Atlantic Oscillation an even larger impact on global liquified natural gas prices.

Our expectation for the predominant phase of the winter North Atlantic Oscillation is not totally clear at this point, but we will continue to update the outlook as the winter nears and the picture becomes sharper.

Will other energy sources, like renewable power, play a role in Europe’s energy crunch this year?

Historically, it has primarily been energy demand, as discussed above, that was heavily influenced by the weather. However, because of climate and energy security concerns, governments around the world have encouraged the expansion of wind and solar power on the electricity grid. This has caused the supply of electricity to become much more sensitive to the weather as well (something that is a research interest of mine).

There’s not a great deal of solar power available during European winters, but there is a lot of wind power potential. As such, wind power now accounts for 10% of all energy consumption in the United Kingdom (Figure 7), with that fraction expected to continue to grow significantly.

Ideally, if there were more energy demand due to cold weather, there would also be more wind to supply that demand (especially considering plans to electrify space and water heating going forward). And it does tend to be windier in the winter in the United Kingdom than in the summer.

But that is where the good news stops. When the North Atlantic Oscillation is negative, and there is more winter heating demand due to colder than normal temperatures, there also tends to be less wind to supply that enhanced demand.

Making matters worse, cold temperatures and enhanced energy demand are also associated with net lower solar resources and lower hydropower resources (Figure 8). The fact that these resources covary and often in a way that exacerbates energy shortfalls—described as “energy compound events”—creates situations of extreme stress on the grid due to simultaneously low supply and high demand, both caused by the weather.

However, the situation is even a bit more complex than this. For example, as the climate warms, the historical relationship between the North Atlantic Oscillation and European weather may be changing. For one thing, as arctic sea ice continues to decline, there is more open ocean north of Europe than there used to be. This means that below-freezing arctic air travels over relatively warm liquid water for longer than it used to before reaching Europe. This can mean that the cold temperatures previously associated with a negative North Atlantic Oscillation may not have nearly the bite that they used to.

These and many other considerations must be taken into account simultaneously if one wants to get the clearest possible picture of the potential severity of any given winter ahead of time. This is precisely what seasonal forecasting systems are tasked with doing, and we will be covering the latest output from these systems every two weeks or so going into the winter:

The latest rundown of the seasonal forecast for this upcoming European winter [9/30/2022]