Wide-Body Aircraft

Case Study No. 2 in How to Make Nuclear Innovative

-

-

Share

-

Share via Twitter -

Share via Facebook -

Share via Email

-

In this case study:

- Brief History of the Commercial Aircraft Industry

- Nuclear and Aviation: An Industry Comparison

- Major Setbacks in Innovation

- Role of the State

- Importance of Intellectual Property

- Regulator Comparison

- Major Innovation Success Stories

- Lessons Learned for Nuclear

The modern commercial aircraft industry, specifically medium and large wide-body aircraft, bears a striking resemblance to the civilian nuclear power industry in both market structure and technological complexity. Both industries are segregated between the vendors that provide the technology—aircraft manufacturers and reactor developers—and the companies that use and operate these products—airlines and electric utilities. The operators in both industries, airlines and utilities, have very small profit margins: roughly 3% for airlines1 and 10% for investor-owned utilities in the United States. Both markets are heavily concentrated, with less than ten major firms. Aircraft production in particular is one of the most concentrated markets in the world (and Paul Krugman argues that the market is really only big enough for one firm2,3).

Both industries can also be strongly affected by exogenous events. With airlines, accidents and security concerns reduce air travel, along with disease outbreaks, blizzards, and volcanic eruptions. A decline in air travel either from an accident or an economic recession greatly reduces orders for new aircraft. Similarly, a major nuclear power accident leads utilities to cancel planned projects and even prematurely close existing plants. Even an unrelated event like a terrorist attack can reduce the demand for nuclear power plants, as they are seen as more prone to risks in general.

Both nuclear power and aircraft manufacturers, finally, share large entry costs for new firms, gradual innovation, imperfect competition, and the fact that many countries consider them “strategic” industries,4 which usually coincides with substantial state support.

And yet commercial aviation appears significantly more innovative and successful than commercial nuclear power, with miles traveled increasing every year and costs per mile and per passenger falling since the 1970s. The lessons that the nuclear industry can learn are simple but not easy. Market consolidation was a key factor in the success of new aircraft designs, but it only worked because firms have significant state support. While aircraft benefited from learning-by-doing on the assembly line, it takes thousands of aircraft before firms see the return on their investments. Therefore, nuclear reactors will need to get a lot smaller to take advantage of similar economies of multiples. Lastly, aircraft can be built in the United States or Europe and flown by most airlines and in most countries around the world. Can the global nuclear regulator, the International Atomic Energy Agency, develop a similar level of international regulation and licensing?

Read more from the report:

How to Make Nuclear Innovative

Brief History of the Commercial Aircraft Industry

Commercial aviation took off after the Second World War, as excess military aircraft were converted to transport passengers and cargo. Turbojet aircraft were independently invented in the United Kingdom and Germany in the late 1930s, but it wasn’t until 1952 when the first commercial jet airline launched, the state-owned British Overseas Airways Corporation (BOAC). While the introduction of jet aircraft in the1930s affords a very useful study in disruptive innovation,5 this case study will focus on the more recent system of innovation for commercial wide-body jet aircraft, as it bears the most similarities to today’s nuclear reactor industry.

The British dominated the commercial turbojet market through the 1950s with their Comet jetliner. But a series of fatal crashes caused BOAC to ground the entire Comet fleet, and this period opened up space for Boeing to enter the jetliner market with their 707. The novel design of the 707 placed the jet engines underneath the wings, which remains the practice today across all commercial jetliner designs. The 707 proved significantly safer and more fuel-efficient, and led to Boeing and the Americans coming to dominate the commercial aviation industry for the next thirty years. In the 1970s, American aircraft manufacturers had 90% of the free world’s market (excluding the USSR).

The modern commercial aircraft industry bears a striking resemblance to the civilian nuclear power industry.

Today, there is a relative duopoly in the market for large wide-body aircraft (over 100 seats) between the American Boeing and the European consortium Airbus, each with ~40-45% of the market, depending on the year.6 There’s a tie for third largest market share between Brazil’s Embraer and Canada’s Bombardier. China’s Comac, currently with the fifth largest share of the market, is starting to make gains with heavy state subsidies. This market duopoly means that Boeing and Airbus are constantly fighting to gain an advantage over the other in terms of aircraft sales.

In the regional jet market (planes with 30-90 seats), Embraer and Bombardier dominate. Embraer was originally state-owned but was privatized in 1994 (but the state still owns 51%). New entrants in the regional jet market include Russian, Japanese, Chinese, and Indian firms, all receiving substantial state aid. Even Bombardier is receiving state aid for its CSeries.7

Market Trends

From the public’s perspective, the aircraft industry appears very innovative because the cost of flying has declined so dramatically over the last few decades. However, most of these cost declines have resulted from the way airlines were operated rather than the aircraft technology employed. The major factor was airline deregulation, which began in 1978 in the United States. This forced airlines to streamline their businesses and compete for passengers. Deregulation also led to the bankruptcy of several major airlines. Aircraft represent a major investment for airlines, and they compete to get the lowest prices and then plan to operate their aircraft for decades.

After deregulation, costs were cut sharply through improved operations and better methods for filling seats. Today, the major remaining cost to airlines is fuel, which now represents up to 50% of airline operating expenses. Therefore, upgrading an airline fleet to more fuel-efficient aircraft is the simplest way for an airline to reduce costs, although it is also the most cash intensive. Innovation in aircraft design over the last two decades, as a result, has tended to focus on fuel efficiency.

Airlines have also been able to reduce costs by fine-tuning the size of the aircraft in their fleet and on particular routes. In general, increasing the size of an airplane reduces costs through greater efficiency in terms of fuel per seat and seats per flight. On the other hand, larger planes lose out on flexibility in terms of routes, flight frequency, and passenger preference.

For a long time, the trend was toward bigger and bigger jets. In the early ’90s, Boeing and Airbus formed a consortium to explore a very large aircraft; they were hoping to jointly produce the aircraft to share the very limited market. Boeing eventually pulled out, and the story of the Airbus A380 has become a cautionary tale.8 More recently, airlines (and aircraft manufacturers) have been converging on aircraft with 160 seats as the most optimal size. Finding the right size for an an aircraft is a strategy that the nuclear industry should learn from, although there might be different optimal sizes for different markets.

To give some perspective on the size of the aircraft industry, Boeing has estimated the demand for aircraft (from all manufacturers) over the next fifteen years.9 The last column shows the average catalog price of a plane in each category. Boeing estimates the total value of planes demanded over the next fifteen years will be $5,200 billion.

R&D Budgets

Over the last decade, Boeing’s annual R&D budget has been between $3 and $7 billion and between 3% to 10% of their total annual revenue. From 2000 to 2004, Airbus outspent Boeing on R&D by 100% ($8 billion compared to Boeing’s $4 billion).10 More recently, though, Boeing has been outspending Airbus on R&D, with Boeing spending $3-$7 billion annually11 and Airbus spending only $2.7 million in 2013.12 It’s suggested that Boeing draws on R&D funded as part of its defense contracts, and that Airbus may rely more on R&D from universities and national labs. In 2014, revenue from Airbus’s commercial aircraft division was $46 billion,13 while Boeing’s revenue was about $86 billion.

Nuclear and Aviation: An Industry Comparison

Compared with commercial jets, the nuclear industry is less concentrated. While there are only seven reactor developers building around the world today, the largest market share is only 28%, tied between Rosatom and the China General Nuclear Power Group. Following these big two, Westinghouse Electric Company and the Korea Electric Power Corporation each have around 12% of new builds.14 Areva NP, the Nuclear Power Corporation of India, and GE-Hitachi, finally, each have around 6% of the reactors under construction globally.

While Boeing and Airbus each spend around $3 billion annually on R&D, nuclear companies invest significantly less.

While there are more competitors, the market for nuclear power plants is much smaller. Boeing delivered 748 jets in 2016, at a market value of $94 billion.15 In comparison, only ten nuclear reactors came online in 2016. In the last ten years, only about five nuclear reactors have come online each year, with a pricetag of $2-$5 billion.

While Boeing and Airbus each spend around $3 billion annually on R&D, nuclear companies invest significantly less. Rosatom invests 4.5% of its annual revenues into research, or about $360 million in 2013. The latest figure for Areva is from 2007—they invested about $644 million into R&D, but that was across their products and services. Across all of the OECD, total spending on nuclear fission R&D was less than $1 billion in 2015 (that includes public and private R&D). However, this figure excludes Russia, China, and India, all of which are investing heavily in nuclear.

While Boeing has been the global leader in jet aircraft production for almost sixty years, their business success has followed a roller coaster. Aircraft production is very capital intensive, and demand follows broad economic trends in addition to responding to exogenous events like terrorist attacks, high-profile crashes, and even volcanic eruptions. Boeing had to significantly cut payroll in the 1920s, during the Great Depression, after the Second World War, in the 1960s, and in the 1970s. After 9/11, Boeing nearly halved payroll, as the entire aviation industry struggled. While Boeing made several business risks that ultimately paid off, other innovative firms were not so successful.

The Concorde (and the Tupolev Tu-144)

Since the 1950s, many countries have expressed interest in supersonic transport jets. However, the costs to develop such an aircraft were expected to be huge. The major US aircraft manufacturers at the time—Boeing, McDonnell Douglas, and Lockheed—decided it was too great an investment and didn’t pursue the technology. However, a British and French alliance formed in 1961 to develop the world’s first supersonic passenger jet, and they successfully brought the plane—known as the Concorde—to commercial operation in 1976, at a joint cost of $1.3 billion. The British-Franco team had to overcome significant technical challenges in metallurgy, structural integrity, and the cooling of the heated airframe. But eventually a commercial aircraft was produced that could travel twice the speed of sound, and at such high altitudes that passengers could see the curvature of the Earth. However, while the plane succeeded on technical grounds—it cut the flight time from London to New York almost in half—it failed on economic and political grounds.

Many accused the Americans of intentionally trying to thwart the success of the Concorde, since they abandoned their own supersonic transport program, but the truth is that the Concorde faced many self-inflicted problems. Despite its supersonic speeds, the plane had a short flying range and poor fuel economy, meaning that it had to stop frequently for refueling. For example, the Concorde had to make two refueling stops between London and Sydney, but the subsonic Boeing 747 could make the trip nonstop, which meant it actually got their faster overall. And the Boeing 747, a new plane itself, cost 70% less per passenger-mile to fly.16 Noise was a nontrivial issue, both when aircraft took off and the boom created when they went supersonic. Several countries would not allow the Concorde to fly over their airspace, which limited the routes available to those primarily over oceans. Over 100 Concordes were originally ordered, but only 20 were ever built, and only 14 were actually delivered to British and French airlines. In 2000, the Concorde suffered its first and only crash, killing all 100 passengers, 9 crew members, and 4 people on the ground. Following the crash and a market-wide slump in air travel following 9/11, British Airways and Air France announced the retirement of the Concorde in 2003.

The Russians developed their own supersonic transport, the Tupolev Tu-144, that was mostly a copy of the Concorde, but after it crashed at the Paris Air Show in 1973, it was only flown for cargo transport within Russia.

Because of aviation’s strategic importance to state militaries, the industry has always benefited from strong state support in one form or another. Boeing got a big boost from the government in 1929, when Congress passed a bill requiring the US Postal Service to fly mail on private planes between cities. Boeing’s R&D has also benefited from decades of defense and NASA contracts, where it can shift profits from its military programs to fund development in its commercial programs.

While European aviation firms started out ahead of the Americans, their diversity of small national companies had limited runs of most aircraft lines. To compete with the Americans, a consortium of British, French, and West German aviation companies formed Airbus Industrie in 1970. In the late 1990s, an even larger group of European civil and defense aerospace firms merged to form the European Aeronautic Defence and Space Company (EADS). Airbus receives research and development loans from various EU governments that have very generous terms, often not requiring repayment unless the new jet is a commercial success.

Both Boeing and Airbus accuse the other of taking illegal subsidies and violating World Trade Organization (WTO) rules. A bilateral EU-US agreement from 1992 was meant to reign in state support for aviation by laying ground rules. However, in 2010, the WTO ruled that Airbus had received improper subsidies by receiving loans at below-market rates. Just a year later, the WTO also ruled that Boeing had violated rules by receiving direct local and federal aid, including tax breaks.

Importance of Intellectual Property

Because of the strong competition between Boeing and Airbus, intellectual property protection is very important. Boeing decides whether to patent a technology based upon how visible it is and how easily it can be reverse engineered. If a certain technology is not visible on their aircraft and is difficult to reverse engineer, they won’t apply for a patent, but instead keep the technology as a trade secret.17 Boeing also doesn’t patent any technology they develop for military applications. Boeing is very ambitious in leasing their patents to noncompetitive industries, such as automotives, and they consider their patents a valuable asset.

One of the major technological innovations that defines the Boeing 787 is the use of carbon composite materials. These composites are composed of carbon fibers reinforced by an epoxy resin and are very difficult to manufacture. Because they have joint applications in missile fabrication, Boeing will not share the technology.18 Due to the limited number of potential suppliers for novel materials, and the large demand expected, Boeing entered into a twenty-plus-year contract with the world’s largest producer of carbon fiber. Such long-term supplier contracts are common in aviation to guarantee quality and maintain regulatory compliance. These contracts also help protect IP, and suppliers are precluded from contracting with other firms.

The federal body that regulates aircraft manufacturing and operations, the Federal Aviation Administration (FAA), is actually quite similar to the Nuclear Regulatory Commission (NRC) in many ways. The FAA primarily certifies aircraft designs for “airworthiness” by issuing rules on aircraft design and production. Additionally, the FAA certifies aircraft production facilities (and performs quality control over time) and component and materials production facilities. Unlike the NRC, the FAA spends a lot of time certifying those who operate aircraft as well: airlines, licensing pilots, aircraft mechanics, repair stations, air traffic controllers, and airports.19 While some may ask how nuclear could be regulated more like aviation, such that innovation is encouraged, others argue that aviation should be regulated more like nuclear to place a greater emphasis on reduced fatalities.20 But there are many intrinsic differences between the two industries that require different kinds of regulation.

One of the major differences is that up until 1998, the FAA was in charge of both regulating and promoting air travel. In contrast, the Atomic Energy Commission (AEC) lost this dual designation for nuclear power in 1974. Because of this dual role, the FAA was more concerned with the cost-benefit analysis of new safety regulations, and whether they would impose unnecessary financial burdens on airlines.21

In a 1997 New York Times analysis, Matt Wald argues that the main reason for these differences is consumer choice.22 You can choose which airline to fly and even which aircraft you fly on, but you can’t really choose where you get your electricity. And while utilities can choose whether or not to build a nuclear power plant, they usually can’t opt to get their power from a different nuclear plant down the road if their local reactor is underperforming. Hence, nuclear power operators have collaborated much more in setting standards and sharing best practices.

Modern wide-body aircraft encompass a diversity of innovations.

Since airlines are publically traded companies, the FAA has a strong incentive not to highlight accidents, safety violations, or underperformance, as this would negatively affect the reputation—and stock price—of the specific airline, whereas the NRC frequently publishes small accidents, safety violations, and performance records of all plants.23 There is also a much larger bureaucracy for regulating nuclear: for every federal employee of the FAA there are 71 employees regulated in the airline industry, whereas in the nuclear industry there are only 6 employees for each federal employee at the NRC.24

Another major difference is that the airlines were deregulated in 1978. While some utilities started deregulating in the 1990s, there are still over 20 states that have regulated energy markets. Before and after airline deregulation, many worried that deregulation would lead to a moral hazard with regard to safety. Indeed, airlines that spent less per flight on safety had a higher frequency of accidents, and this problem was even more noticeable among airlines with financial trouble.25 Nuclear power, on the other hand, seemed to improve in performance and safety under deregulation,26 although deregulation has made it more difficult to build new nuclear power plants. In contrast, the competition among airlines has seemed to spur innovation among aircraft manufacturers, as airlines demand the newest and most efficient new aircraft models to stay competitive.

However, this lax regulation by the FAA should in theory be offset by a certain amount of self-regulation by the airlines and aircraft manufacturers precisely because airlines are publically traded and consumers have so much choice in air travel. If an airline has an accident, this is almost instantly reflected in a drop in stock value. However, airlines and nuclear power operators both have very minimal market responses in reaction to high-publicity accidents, as compared with less rigorous regulatory bodies like the Food and Drug Administration, the Occupational Safety and Health Administration, and the Mine Safety and Health Administration. But there is a big difference in how much each industry is willing to pay to prevent fatalities. A 1986 report estimated that many of the recent FAA safety regulations would cost airlines about $700 (1986 US dollars) per life saved.27 In comparison, in 1995, the NRC set a new value of $1,000 to prevent one person-rem of radiation exposure,28 a dose that will not result in a fatality.

At the international level, air travel is regulated by the UN agency the International Civil Aviation Organization. Flights and aircraft are governed by a set of standards and best practices referred to as ETOPS (extended operations), which were based on a mix of current FAA policy, industry best practices and recommendations, as well as international standards. Most interestingly, ETOPS is a performance-based standard to some extent. Originally, airliners were tested and certified to an ETOPS-180 standard, which meant they had to prove that the aircraft could fly 180 minutes and land with only one functioning engine (out of two). For their first year of flight, the airliner’s routes were always within 180 minutes of a certified landing strip for just this purpose. But after a year, or 18 months, if the aircraft had performed as expected, it might get approval to extend to ETOPS-240 and later ETOPS-360. These standards were developed with heavy input from both Boeing and Airbus, the airlines, international regulators, and even the Air Crash Victims Families Group. This broad stakeholder engagement on safety led to regulations that serve a dual purpose of protecting passengers as well as allowing efficient long-range flights for airlines.

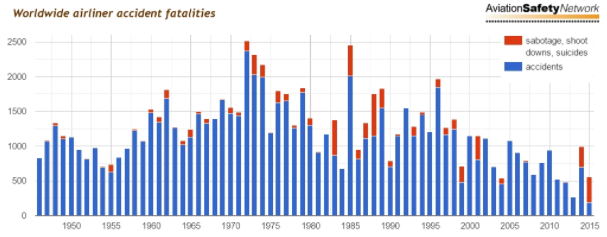

2015 was the safest year on record for the airlines, with the lowest number of fatalities from accidents. (Source: The Telegraph,“2015 was the safest year in aviation history,” January 6, 2016, http://www.telegraph.co.uk/travel/news/2015-was-the-safest-year-in-aviation-history/.)

Despite the seemingly lax regulation of airline safety, the number of fatalities from aircraft accidents has been declining for decades.29 Considering the growth of commercial airline travel over this time period, the relative probability of fatalities has decreased dramatically. Although it is worth noting that the number of annual fatalities is still three orders of magnitude greater than those due to commercial nuclear power.

Major Innovation Success Stories

Most of the innovation taking place in aviation is incremental, with minor improvements in aircraft weight, fuel efficiency, and performance. While many of these incremental innovations have had significant effects on the cost and operability of commercial aviation, below are more detailed case studies of significant (and successful) major innovations in modern aviation.

Jet Turbines

The aircraft industry successfully introduced a major technological change with the introduction of turbojets as an alternative to propeller planes. Turbojets were much preferred for commercial airlines because they were faster and came with much less turbulence, meaning more comfort for passengers. But turbojets were originally the pipedream of aerodynamics scientists, not aviation engineers, and they remained a purely academic exercise for almost a decade, with most aircraft manufacturers predicting they would never be practical since their fuel consumption was so high. However, turbojets took a big leap forward as a result of World War II and the invention of radar. Before radar was able to detect incoming bombers, large prop planes would patrol the skies for long periods ready to attack—thus fuel efficiency was a matter of life and death. But with the introduction of radar, planes could sit on the tarmac and only needed to take off when a bomber was detected; as a result, take-off speed and flight speed replaced fuel efficiency as critical concerns. The turbojet filled this niche perfectly.30 Significant money was spent to research and develop turbojets by the British Air Force, which led to rapid prototyping, testing, and deployment. Post-WWII, the American government dumped surplus aircraft into the commercial market at drastically reduced prices, which created a boom in commercial air travel.

But turbojets were still not an initial commercial success. Military turbojets flew very little and sat stationary most of the time. Commercial jets would be flown almost continuously to maximize profit, and therefore military jets were not well suited to commercial use, as many components broke quickly and materials wore out within a few months, leading to accidents and expensive repairs. In 1945, the major airlines created an international cartel to keep commercial prices artificially high, which allowed a buffer for airlines to purchase airplanes at high upfront costs. These bigger planes often flew only half-full of passengers, and airlines were losing money. Thus, they had to introduce new market mechanisms like economy class tickets to attract passengers and turn a profit with these bigger planes (similar to how large nuclear plants need to run 24/7 to be profitable). The high speeds of turbojets required longer and concrete runways to replace grass fields. The noise of such aircraft required them to fly at high altitudes, which meant cabins now had to be pressurized.

Fly-By-Wire

The Airbus A320 was the first airliner to fly with an all-digital fly-by-wire control system, a technology originally developed for military aircraft and used on experimental space shuttle flights. Digital fly-by-wire technology essentially enables planes to be flown by computers. The workload for pilots is simplified and reduced, and many adjustments are made automatically. This has reduced the weight and complexity of mechanical control systems and has also improved the safety and performance of airliners, as it reduces human error.

Boeing 787 Dreamliner

In the late 1990s, Boeing was investigating new airplanes to offset the sluggish demand for their 767 and 747-400. Initially, they were aiming for much faster airplanes (Mach 0.98), but after the 9/11 attacks most airlines were focused on reducing costs. In 2003, Boeing announced the development of a radically more fuel-efficient wide-body aircraft that would be available in 2007.

The main innovation that Boeing took advantage of for the 787 was replacing steel with composite materials in many of the plane’s components, most importantly the wings. These composite materials allowed for wing shapes that had superior aerodynamics not possible with conventional materials. These innovations combined to reduce fuel use by 70% and reduce noise footprint by 90%. Noise might not seem like a big deal, but it affects which airports the planes can use and what speed they can go when taking off and landing. The improved fuel efficiency would not only reduce costs for airlines, but also greatly extend the range of passenger routes and increase the load that cargo planes could carry.

The total program cost $32 billion,31 but it will take time for Boeing to realize a full return on this investment. The very first orders for the 787 were placed in 2004 by a Japanese airline, but the aircraft suffered serious delays in production, meaning the first planes weren’t delivered until 2011, four years late. The main cause for the delay was Boeing’s global distribution chain, where subcomponents are manufactured around the world and flown to Everett, Washington, where they are assembled. This process was thought to be revolutionary and was expected to dramatically reduce assembly time, but has proven the opposite. The 787 is assembled from subcomponents manufactured in Japan, Italy, South Korea, the United States, France, Sweden, India, and the United Kingdom. This should serve as a warning for the nuclear industry proposing a similar supply chain structure for large modular reactors like the AP1000. A single 787 costs approximately $224 million.

Below is a chart of the orders placed for Boeing 787s and actual deliveries. Boeing has delivered a total of 318 aircraft as of 2015.

Airbus A380

As mentioned above, Airbus began in collaboration with Boeing on a very large aircraft in the early 1990s, before Boeing left the partnership. Airbus—a European consortium of aircraft manufacturers—continued with the development of what would become the A380, the world’s largest commercial aircraft. Airbus spent the rest of the ’90s exploring options for their next aircraft and performing hundreds of focus groups with airlines and passengers. In 2000, Airbus officially announced the start of a $10 billion program to develop the A380 with 50 firm orders from six airlines. The A380 can accommodate 853 passengers and has 40% more floor space than the next largest aircraft, Boeing’s 747.

Airbus employs many of the same innovative materials and technologies as the Boeing 787, although developed independently. Unique among the A380 jetliners is the development of a central wing box made of composite material and a smoothly contoured wing cross section.32

However, development of the A380 suffered many delays that reduced its economic viability and allowed Boeing to gain market share. Flight tests began for the first A380 in 2005, but trouble with wing failure meant that the design wasn’t certified until 2007. Production delays occurred due to the extremely complex wiring involved (over 500 kilometers of wiring in each aircraft), and the differing wiring standards between German, Spanish, British, and French component facilities. Because of the large size of the A380, an extremely specialized supply chain was developed (shown below) to allow movement of the gigantic subcomponents by barge, whereas Boeing can fly subcomponents by its own planes.

The first completed A380 was delivered to Singapore Airlines in 2007, but Airbus has so far delivered only 169 A380s. While no longer operating at a loss, they do not think they will ever recoup the full investment cost.33 Each A380 has a retail cost of $450 million.

Modern wide-body aircraft encompass a diversity of innovations, both technological and in terms of innovative practices in manufacturing, supply sourcing, designs, and pricing. However, the predominant theme is that these innovations were driven by customer demands, whether from airlines or passengers. In an aggressive market with a strong duopoly, the major aircraft manufacturers were constantly looking for a way to gain advantage. Innovation was targeted at reducing costs for the major expense for airlines: fuel. New designs allowed higher profits for airlines along with greater flexibility in routes and longer ranges.

Economies of multiples proved much more important than economies of scale. Airlines had to find the right-sized aircraft to strike a balance between economies of scale and business flexibility. However, large planes came with many challenges. Most importantly, it takes airline manufacturers hundreds to thousands of airliner units before they recoup the cost of investment in a new design (and maybe they still never recoup the cost in Airbus’s case). But Boeing and AIrbus plan for this and structure the retail cost of the aircraft accordingly. Airlines are willing to pay a premium for the first deliveries of a new aircraft to please customers. In addition, developing a robust supply chain takes a large and consistent demand for aircraft. For example, Airbus sold 626 jetliners in 2013, and currently has over 13,000 standing orders across their four major designs.34

The lessons that the nuclear industry can learn are simple but not easy.

Both Boeing and Airbus had firm orders from airlines from the very early stages of aircraft development. This allowed them to receive feedback on what customers wanted as well as to work on a strict timeline for delivery (they both failed to deliver on time, but they delivered extremely fast compared with the nuclear industry). Airlines are willing to place orders far in advance for two reasons: they trust the reputations of the manufacturers to deliver, but more importantly, they are competing with all other airlines to offer the newest, most efficient airliners. For the nuclear industry to develop this level of advance orders, several major changes would need to occur. First, reactors, or at least major components, would need to be factory produced and sold at a fixed price. Second, utilities would need a guaranteed delivery date for their orders. Currently, nuclear projects are consistently far behind schedule and over budget, which doesn’t allow utilities to adequately plan for future supply.

Globalizing and diversifying the supply chain proved challenging and led to delays, even for the two giants of the aircraft industry Boeing and Airbus. Large components and novel materials required entirely new manufacturing facilities that had to be built from the ground up around the world. The nuclear industry should take particular note of this experience. China, for example, is trying to indigenize the entire supply chain for their reactor, the CAP-1000.

[1] “2015 Aviation Trends,” PricewaterhouseCoopers, http://www.strategyand.pwc.com/perspectives/2015-aviation-trends.

[2] Krugman, P. R. Is Free Trade Passe? J. Econ. Perspect. 1, 131–144 (1987).

[3] Baldwin, R. E. & Krugman, P. in Trade Policy Issues and Empirical Analysis 45–77 (1988).

[4] Benkard, C. (1999). Learning and Forgetting: the Dynamics of Aircraft Production. The American Economic Review 90, no. 4 (1999). Retrieved from http://www.nber.org/papers/w7127.

[5] Geels, F. W. Co-evolutionary and multi-level dynamics in transitions: The transformation of aviation systems and the shift from propeller to turbojet (1930–1970). Technovation 26, 999–1016 (2006).

[6] Trefis Team, “New Entrants Pose a Challenge to Boeing’s Share of the Global Commercial Airplane Market,” Forbes, March 6, 2014, http://www.forbes.com/sites/greatspeculations/2014/03/06/new-entrants-pose-a-challenge-to-boeings-share-of-the-global-commercial-airplane-market/.

[7] Curtis, T., Rhoades, D. L., Curtis, T., Rhoades, D. L. & Jr, B. P. W. Regional Jet Aircraft Competitiveness: Challenges and Opportunities. (2013).

[8] Benjamin Esty and Pankaj Ghemawat, “Airbus vs. Boeing in Super Jumbos: A Case of Failed Preemption” (working paper, Harvard Business School, Boston, 2002). http://www.people.hbs.edu/besty/Esty_airbus_Boeing.pdf.

[9] Boeing. Current Market Outlook 2014-2033. (2014).

[10] Pandey, M. R. How Boeing Defied the Airbus Challenge. (2010).

[11] Aeroweb (The Boeing Company [NYSE:BA] Research [R&D] Spending), https://www.fi-aeroweb.com/firms/Research/Research-Boeing.html.

[12] “Airbus Division’s R&D expenses from FY 2010 to FY 2016 (in million euros),” Statista, http://www.statista.com/statistics/226726/rundd-expenditure-of-airbus/.

[13] “Ad-hoc release: Airbus Group Achieves Record Revenues, EBIT* and Order Backlog in 2014,” Airbus, February 27, 2015, http://www.airbusgroup.com/int/en/news-media/press-releases/Airbus-Group/Financial_Communication/2015/02/20150227_Ad-hoc_Airbus-Group-Achieves-Record-Revenues--EBIT--And-Order-Backlog-In-2014-.html.

[14] “Under Construction Reactors,” IAEA, May 2, 2017, https://www.iaea.org/PRIS/WorldStatistics/UnderConstructionReactorsByCountry.aspx.

[15] Dominic Gates, “Boeing jet sales fell by 100 last year, but outdelivered Airbus,” January 11, 2017, http://www.seattletimes.com/business/boeing-aerospace/boeing-sold-100-fewer-jets-last-year-but-it-outdelivered-airbus/.

[16] Bess, M. The Light-Green Society. (University of Chicago Press, 2003).

[17] Catherine Jewell, “Giving Innovation Wings: How Boeing Uses its IP,” WIPO Magazine, February 2014, http://www.wipo.int/wipo_magazine/en/2014/01/article_0004.html.

[18] Pandey, M. R. How Boeing Defied the Airbus Challenge. (2010), 182.

[19] Bermann, G. Regulatory Cooperation with Counterpart Agencies Abroad: The FAA’s Aircraft Certification Experience. Law & Policy in International Business 1 (1992).

[20] Matthew Wald, “Why Safety is not Always So Public,” New York Times, March 16, 1997.

[21] Wald, “Why Safety is not Always So Public.”

[22] Wald, “Why Safety is not Always So Public.”

[23] Wald, “Why Safety is not Always So Public.”

[24] Broder, I. E., & Morrall, J. F. Incentives for firms to provide safety: Regulatory authority and capital market reactions. Journal of Regulatory Economics 3, no. 4 (1991), 309–322. doi:10.1007/BF00138471.

[25] Dionne, G., Gagne, R., Gagnon, F., & Vanasse, C. (1997). Debt, moral hazard and airline safety: An empirical evidence. Journal of Econometrics 79, 379–402.

[26] Davis, L., & Wolfram, C. Deregulation, Consolidation, and Efficiency: Evidence from U.S. Nuclear Power. (2012). Retrieved from http://www.nber.org/papers/w17341.

[27] Broder, I. E., & Morrall, J. F. Incentives for firms to provide safety: Regulatory authority and capital market reactions. Journal of Regulatory Economics 3, no. 4 (1991), 309–322. doi:10.1007/BF00138471.

[28] US NRC. Reassessment of NRC’s dollar per person-rem conversion factor policy. Oak Ridge, TN (1995). doi:10.2172/197836.

[29] Aviation Safety Network (fatal airliner [14+ passengers] hull-loss accidents), http://aviation-safety.net/statistics/period/stats.php?cat=A1.

[30] Geels, Co-evolutionary and multi-level dynamics in transitions.

[31] Dominic Gates. “Boeing celebrates 787 delivery as program's costs top $32 billion,” Seattle Times, September 24, 2011.

[32] “Airbus A380,” Wikipedia, May 2, 2017, https://en.wikipedia.org/wiki/Airbus_A380#Materials.

[33] “Airbus A380 Haunted by Feeble Orders Marks Decade in Skies,” Bloomberg, April 26, 2015.

[34] “The Month in Review: March 2017,” Airbus, http://www.airbus.com/company/market/orders-deliveries/.